The year 2017 has been a mix of some uncanny events. While, some deliberately forced the markets to dip, others supported the indices to gain momentum. So what shall investors expect from 2018 and what could be some of the best stocks for 2018 to add to your portfolio in the next few months.

After sound analysis and some contemplation, we have picked a bunch of stocks that if researched and added to your portfolio can reap healthy returns. For various investors the definition of sound investing differs. While some are always on the lookout for best stocks in their growth phase, some go in for value investments that are consistent and can prove to be multibaggers in the long run.

The following list of best stocks is categorized under Large-Cap, Mid-Cap and Small-Cap based on certain specific parameters and fundamental analysis.

Best Large Cap Stocks for 2018

Companies that have grown with the market and are now steady performers

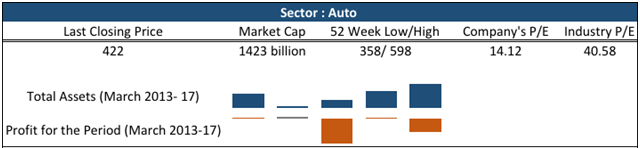

Tata Motors

With an insightful product line and an ever-increasing growth in the sector the stock is awaited to regain its lost charm. A dip in net profit should not deter investors’ expectation. In accordance with high sectoral growth and robust financial the stock is a must have in your portfolio. The current market price provides an opportunity to enter.

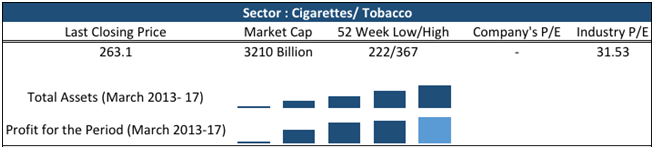

ITC Limited

A stock with a comprehensive market share. I stated “Comprehensive” because of its product line and how well the company has pulled out in the tobacco market. The company has managed to decrease debt by huge proportion and has managed to bring its current ratio from 1.70 in 2013 to 3.59 in 2017. The stock has a lot of potential in terms of its financials which will be reflected in its stock price soon.

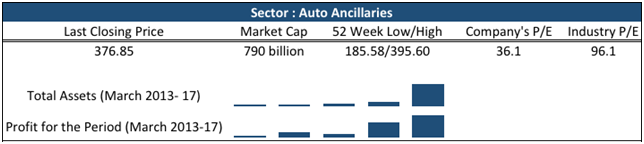

Motherson Sumi

A popular name for equity mutual funds and value investors, the stock has always portrayed sound financials within the industry and between peers. The company has managed to increase its asset base as a firm in the Auto Ancillary sector with a robust P/E which is evident from fundamentally strong revenue growth. The stock is currently trading at less than its 52 week high and could be a good investment if you are looking at a 5-7 year horizon.

Best Mid Cap Stocks for 2018

Value is what a company generates, Returns are what Investors Get

As a value investor myself I am always on a lookout for firms which exhibit strong financials and a unique product composition. Most companies in the mid-cap space have outperformed markets on various fronts teamed with intense risk. While going in for mid-caps seek companies which have a robust moat or a deliverable competitive advantage, difficult to replicate.

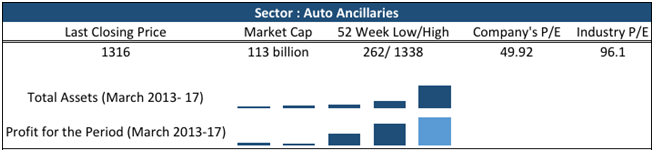

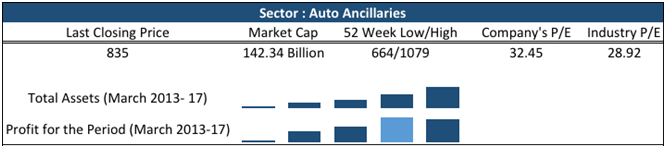

Minda Industries

With a CAGR (Compounded Annual Growth Rate) of 20-25% due to strong sectoral growth clubbed with addition of new products the stock is currently trading at an all-time high. The company has carved a niche for its products in the Auto Ancillary sector with robust margins, additional capacities and dynamic improvement in its top-line numbers. I first came across this stock when I was seeking the portfolio of a mutual fund that I owe in March 2016 and ever since then, it has been on a splurge.

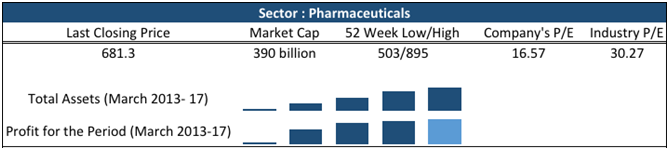

Aurobindo Pharma

If you glance at both the top and bottom line figures of the firm, you can see evidences of the turnaround the company has witnessed. A lot of portfolios have been shuffled in contrast with Sun Pharma where people are relying on Aurobindo for its viable growth. The stock seems reasonably placed and with growth resonating every quarter you can’t aim to miss on the huge potential it stores. Profit making capabilities of the firm is intense, so are the unique markets it seeks to enter like Europe for inorganic growth. Its specialized segments include drugs for a wide variety of generic and contractual ailments and diseases.

Amara Raja Batteries

Though the stock seems a bit over-valued than its peers in the auto battery space, it’s a good inclusion in your portfolio. The stock has provided close to 30% returns in the last successive years on a per year basis. Last week the shares of the company saw a tremendous intra-day hike of 4.7% after it commissioned a two-wheeler battery plant in Chittoor. The management of the company inflicts a sense of comfort since it seeks to enhance its company’s operation through expansion.

Best Small Cap Stocks for 2018

Small seems nasty but returns on these stocks can be a game changer and might turn out to be the best stocks for your portfolio.

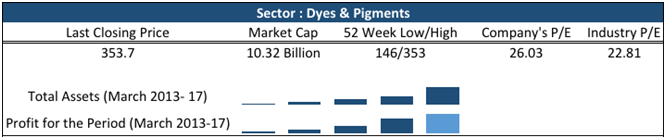

Ultramarine and Pigments Ltd.

With a 20% rise in its stock price, the company is hard to neglect. The company posted exquisite revenue numbers for Q2, with consistency in net profit and an ever rising product demand. The stock has outperformed market on various levels in the last one year.

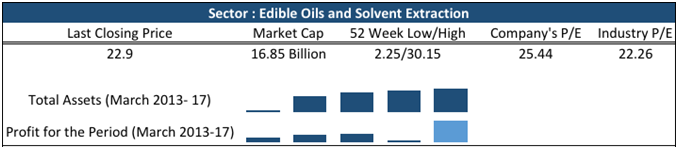

Sanwaria Consumers

The company entered as an agro oil manufacturer but later transformed its operations into deeming a complete package to consumers. The company is a bit over-valued if compared with the industry multiple but still seems a reasonable buy when fundamentals are closely analyzed. Which firm has such robust profits and an asset line in close sync with it market cap. Even if as an investor you are reluctant to add this in your portfolio it could be a great addition to your watchlist. In contrast, the transformation has yet to be tested in close waters with industry peers and consumer space.

With the new year around the corner, I feel as investors we must start to weed out sluggish performers and be on a hunt for companies that seem as prospective potential gainers in the long-run. Best stocks mentioned above have been analyzed on various fronts and might not fit in your requirement at some point but they are worth your research time.

Disclaimer: The article is in no way an advice to buy or sell any stock; rather it provides a base for the investor’s own research. Consult with a registered investment advisor, prior to making any trading decision of any kind.

Pingback: GAIL India Share Price Hits Lifetime High, Should you Sell?