The year 2018 is here and many people are wondering what is in store for Bitcoin and other cryptocurrencies. A look at the trend of events linked to the wonder coin in 2017, gives an idea of the Bitcoin 2018 prophecies.

The highpoints of the year 2017 for Bitcoin was its grazing the 20,000USD mark, rogue attacks on exchanges, China’s attempt to muzzle it, and the open embrace by Main Street.

Beyond all the euphoria and hysteria, my Bitcoin 2018 prophecies are presented below:

Bitcoin 2018 Price Forecast: Raging Price Surge

Bitcoin 2018 prophecies indicate that the Bitcoin price Bull Run will continue well into the year. As more people sign up and secure their share of cryptocurrencies, the law of demand and supply will ensure that further price spikes will occur.

Do not forget that what is happening so far to Bitcoin is more of an unveiling than anything else. More people are already attracted to it, and this will continue in 2018. But lovers of stargazing will want to know at what price it is likely to peak.

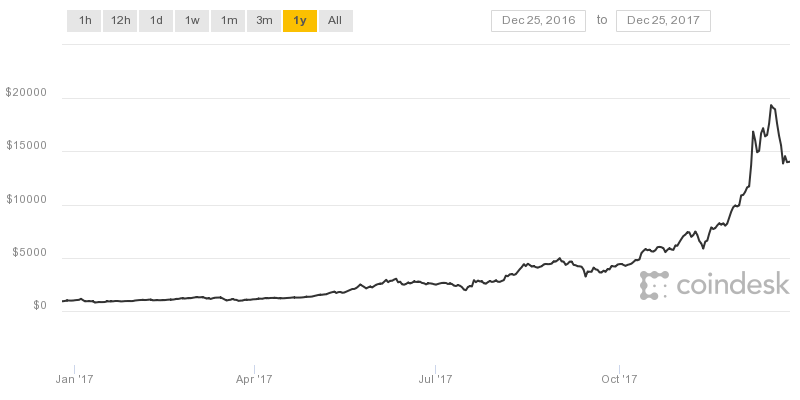

In 2017, as the last quarter of the year beckoned, the consensus was that since the trading price of BTC/USD was under $4,000, it should be able to end the year at the $5,000 mark. This earlier optimism got a boost when market watchers reversed the outlook by mid-November 2017 to $ 20,000.

Surprisingly, this was not only surpassed, it maintained the $ 15,000 mark after grazing $ 20,000 on 14th December 2017. If the historical performance for 2017 is anything to go by, in 2018, you should expect that the BTC/USD price surge will nest at $ 50,000 by mid-year.

A mid-year slump in price should also be expected after BTC/USD reaching the $50,000 mark. What will give rise to the price slump? Hacking threats, government intrusions and maybe a ground breaking altcoin!

More Wanton Hacks

In the course of 2017, there were up to five reported attacks on Bitcoin exchanges which led to some remarkable losses. It is clear that bad news sells fast and can be damaging. Hackers have being a pain in the ass for traditional banking institutions with losses estimated at more than $400 billion a year.

Bitcoin hacks in 2017 led to losses of millions of dollars. In the NiceHash hack of December 2017, about 70 million USD was lost. Tether Treasury lost 31 million USD in November 2017, while BitThumb lost less than 1million USD in July 2017. The biggest loss to hackers in the Bitcoin sphere was the Mt.Gox hack of 2014, where losses equate 460 million USD based on prevailing market price.

The news of these hacks depresses the Bitcoin market and leads to price slumps. Bitcoin 2018 prophecies indicate that more of these should be expected in 2018, and they will serve to stymie the price run.

More Attempts to regulate Bitcoin

At some point, government intervention in Bitcoin trade in China during the course of 2017 made the headlines. Although it momentarily led to a global price slump for the cryptocurrency, the market plateaued afterwards.

The Bitcoin forecast 2018 indicates that such government intrusions should be expected in 2018, and this can take various forms.

Deepened Acceptability

While Central Banks are displeased in their inability to rein in cryptocurrencies, major finance players like Goldman Sachs have joined the fray with its Startup company-Circle operating a trading desk for Bitcoin. The launch of a Bitcoin futures trading at the CBOE global markets have also led to Bitcoin ETFs getting legitimized.

Other initiatives like the launch of a Bitcoin-based Hedge Fund by the AngeList pioneer have made the news in recent weeks. All of these developments tell us that the Bitcoin 2018 acceptability outlook is positive as the wonder coin will go increasingly mainstream in 2018.

More Blockchain Uses Discovered

The Bitcoin 2018 prophecies also point at the already evolving uses of the Blockchain. Smart contracts were a real attraction during the course of 2017, and this should further escalate in 2018.

Uses for the Blockchain have expanded to healthcare delivery as shown by the Healthureum initiative, which is revolutionizing healthcare delivery systems by leveraging on the possibilities of the Blockchain.

Storj is another initiative that uses the Blockchain for data storage and encryption, and has also made headlines. Systematically, these initiatives particularly also draws more attention to Bitcoin, Ethereum and the altcoins.

You should expect that more research efforts on the Blockchain will yield results in the course of 2018, and Blockchain initiatives will become more visible.

A Fortune Foretold

From the insights here in the Bitcoin forecast for 2018, it is better accepted that Bitcoin is here to stay. The Bitcoin price run is assured in 2018 despite the foreseen setbacks. The Bitcoin rally will recover after each slump and peak at a stable price.

Pingback: Ripple Price Prediction: XRP to USD Facing Uphill Task

Pingback: Bitcoin, Cryptos and Equities Tumble and Slowly Recover Globally