The US dollar has fallen to a three-month low against most major and emerging-market currencies, due to the rise in crude oil price and gold price. The US dollar is also expected to fall due to the strength in Chinese and European manufacturing leading to the growth in those countries.

As a result, the investors are expecting better returns in other currencies compared to dollar as the global growth picking up. The weakness in US dollar is expected to remain in 2018 as more central banks move toward the policy normalization. Therefore, there is a cloudy outlook for dollar as the Federal Reserve has signaled more three rate hikes in 2018.

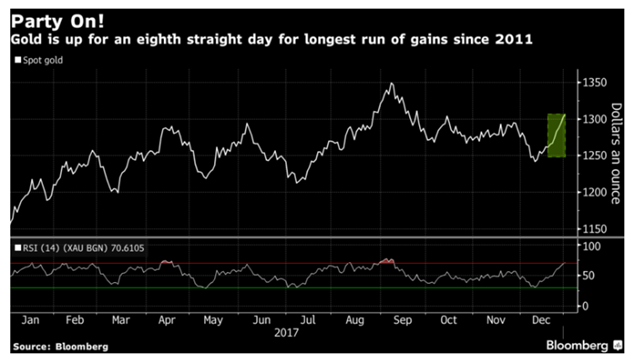

Strong Run-up for Gold

The gold is having run up continuously from eight days which is the longest stretch of gains since mid-2011. The Gold had a strong rise in 2017 even the Federal Reserve had increased the interest rates three times and has signaled US as an improving economy. The rise in gold price is due to the fact that U.S. rates continue to be astoundingly low.

Apart of the Fed policy makers projection of rate hikes in 2018, the other central banks around the world are tightening the monetary stance, as the European Central Bank is planning to halve its asset purchases starting this month. The higher rates generally make non-interest-bearing assets such as gold less competitive. As per the analysts’ the gold is now at very overbought levels and the gold price may be set for a decline.

Gold Price Chart 2017

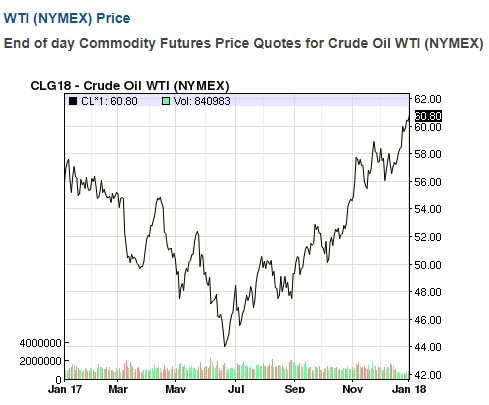

Crude Oil Price Chart 2017

Brent Crude Oil Futures at $66.55 a barrel

Brent crude futures, which is the international benchmark for oil prices were at $66.55 a barrel, down 2 cents but not much away from the $67.29 May 2015 high, from the previous day. The oil prices are rising due to a strong demand and also due to the efforts led by OPEC and Russia to reduce the production that tightened the market. However, the U.S. production is set to rise further but it has to be seen whether the demand growth can continue at current levels.

Overall Outlook

Generally, when the value of the dollar falls, then there is a rise in commodity prices. Therefore, the dollar index has fallen in three months which had led to rise in the gold and oil price.

Pingback: USD to INR Forecast 2018: Indian Rupee to Dominate US Dollar?

Pingback: US Dollar Outlook for 2018: USD Weakening to Continue?