The company has been news for all wrong reasons including the exit of Vishal Sikka, the former CEO of Infosys, paying exorbitant salaries to the top executives and increased attrition rate. But now there is a sigh of relief! Under the guidance of Salil Parekh, the new CEO, the company is growing at a phenomenal rate. Here’s a look at the results.

Untill yesterday, the Infosys investors were feeling jittery about whether this IT major can deliver the good returns or will it trade flat? Well, the Q3 numbers are out.

Q3 earnings of Infosys

Infosys, the largest IT player, reported a 38.3% rise in the sequential growth in net profit at Rs 5,129 crore for the December quarter. The number came much higher than predicted (Rs 3,599 crore) by the analysts in the ET poll, this was also due to tax provision reversal due to US IRS agreement.

In the December quarter, Infosys registered the revenue of Rs 17,794 crore. The number was in sync with Dalal street estimates. The company maintained its FY 18 revenue guidance at 5.5-6.5% in the constant currency.

In Q3 results, the operating margin was improved to 24.3% from 24.2% in the September quarter. Attrition rate has declined to 15.8% from 17.2% in the September quarter. In dollar terms, Q3 revenue has grown by 8% year on tear and 1% sequentially. Remarking on the present Q3 earning results the CEO and MD of Infy said that

“Our Q3 performance is strong. We had 8 per cent year-on-year growth and 24.3 per cent operating margin with $593 million of free cash flow.”

Live: Infosys Q3FY18 Results – Management Commentary https://t.co/KawnruP89Z

— Infosys (@Infosys) January 12, 2018

Is this a new beginning?

The improved scenario is the result of clear vision, and adoption of digital offerings that has helped company to spring up. Though Parekh has promised that the IT sector is growing at a burgeoning rate and the balance sheet of Infosys is penciling high, but the investors need to be cautious because the picture doesn’t seem to be rosy, especially after the news of Infosys President Rajesh Murthy resigned has gone viral after the quarterly announcement. What does that indicate?

Impact on Infosys share price

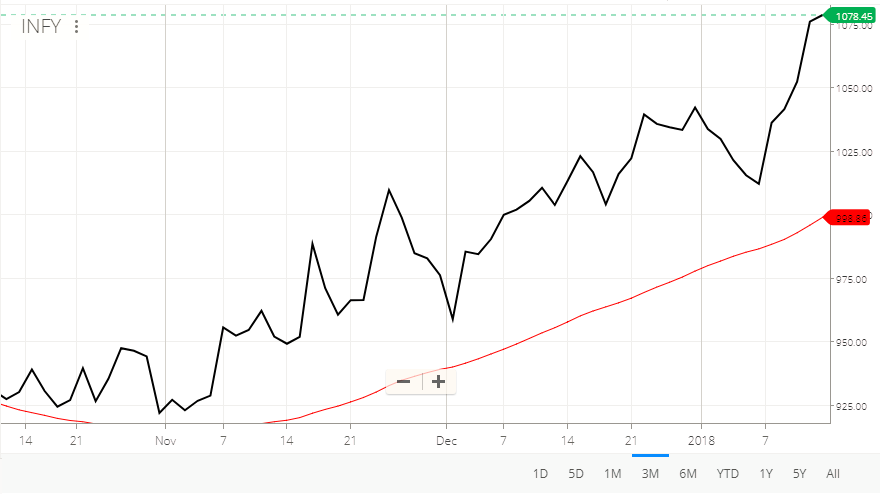

Before the announcement of the quarterly numbers, Infosys was trading flat on Friday, as the investors turned cautious after its peer TCS missed the market expectations, but after the announcement of the results, Infosys share price grew by 0.26% higher than Rs 1078 on the BSE. Looking at the future prospects with continued growth in margin and revenue of the company, we would recommend investors to hold the stock.

Pingback: Newgen Software Technologies IPO Opens 16th Jan, Should you Invest?