Key global steel producers across the globe are witnessing a surge in demand from buyers on the back of firming manufacturing indices. The stocks of these steel players and allied companies are soaring enough to draw the attention of market watchers.

The sunny days for the global steel market can be partly attributed to Chinese clampdown on producers in its drive for cleaner production processes and environment-friendliness. The gap created by Chinese supply shortfalls are plugged by manufacturers from India, Ukraine, Canada and Turkey,

Global stock rally

In Japan, Tokai Carbon Corporation has seen a spike of nearly 180% in stock value while Showa Denko KK has witnessed a rise of twice the opening value as at the beginning of the year. In Germany, SGL Carbon has seen a 66 % surge in value of its stock.

The Indian players have their pleasant stories to tell also and they are examined a bit more closely here.

The Indian key Steel players

Arcellor Mittal

The production of steel involves the supply of steel making components as well as the primary production process. Arcellor Mittal is the leading player in global steel production with a presence in more than 60 countries on earth.

The company’s stocks have seen a 3 month surge that still looks good going into the last quarter of the year. In July 2017, the stock traded for EUR 20.61 but has kept the momentum at above EUR 22.50 since the month of October 2017. There is no doubt that the company is still a buy for stock pickers.

HEG Ltd is one of the leading makers of graphite electrode in India, and this key input is used for producing steel out of scrap metals.

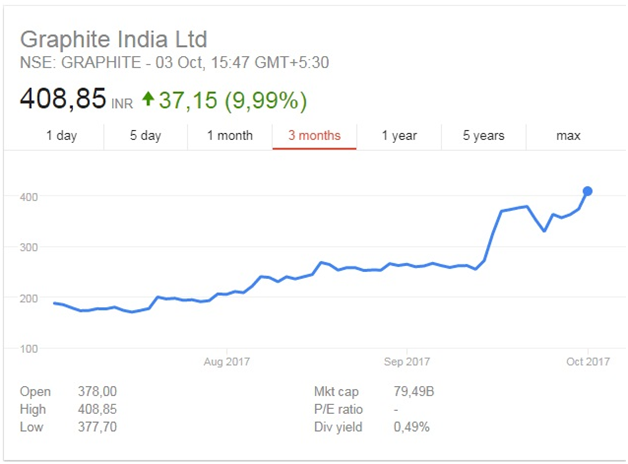

Graphite India Ltd also belongs in this class of interest. These two companies have seen a rise that places them in the class of the best performing stocks among Indian Industrials.

They are both up by margins in the range of 400 % since January 2017.

HEG

ArcelorMittal, U.S Steel Corporation as well as Posco is supplied by HEG, and this point out the strength of the company’s market reach. Annual production is 80.000 tons and its output is expected to be a flat 85 % for the next two quarters till March 2018.

Like other players in the steel sector, needle coke is a limiting factor in the company’s bid to raise output beyond this projected level.

In Mumbai, the stock of HEG has been rosy this year and is tagged as one of the top gainers in the S&P BSE Industrials Index. The stock might top 1,050 rupees in twelve months.

Graphite India

Graphite India has seen close to 500 percent surge in stock value this year. This places it along with HEG on the top of the elite BSE Industrial Index.

Stock pickers already expect this stock to surge further from now till year-end. It might be able to top 524 rupees within a 12 months’ time frame.

Global shortage of key inputs

The use of needle coke and graphite electrodes in steel making is an important facet of the production chain. While Hurricane Harvey disrupted the pace of the U.S Industrial belt, the drop in production levels of previous years, already constrained the capacity of producers to ramp up output.

The production inputs have also become costlier and risen to 10 times its cost at this time last year. It is no doubt a bright noon for electrodes and needle coke makers.

Looking forward

So far, market analysts see further rise in needle coke and this will lead to costlier electrolytes, and maybe costlier steel. While price increases might not be substantial, this is the room for the optimism in stable steel prices going forward. For the major players in the market, it is yet a sunny day!