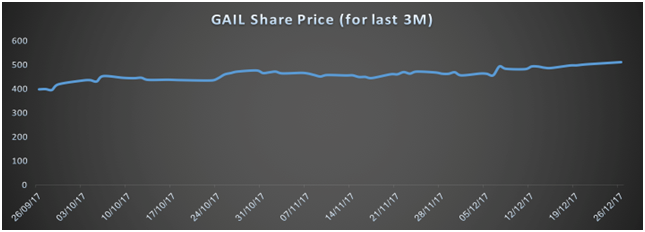

Amidst government’s push towards boosting energy reliance on gas, stocks of energy giants like GAIL, Petronet LNG and ONGC are up for a significant thrust. GAIL India share price hits lifetime high of Rs. 514 today.

On December 18, last week GAIL (India) Ltd. re-negotiated a few contracts to purchase Natural Gas from US- energy majors, Cheniere Energy and Dominion Cove Point to source more than 5.8 million tonnes of LNG. The contract will commence in 2018 and is expected to raise India’s energy mix dominance from a gas view-point by 15% from the current 6%. The current stock movement has some underlying evidence from a host of contracts that GAIL has been lately indulged in. Let us look at some factors that have helped the stock gain momentum.

IOC and BPCL in talks to acquire GAIL

Following Finance Ministries inclination to curate a holistic and integrated oil company which was seen in this year’s budget, a host of oil companies are looking for probable mergers. After the proposal of ONGC to acquire HPCL was approved by the cabinet ,firms like IOC and BPCL has laid down interest in acquiring GAIL to form an integrated oil company where the entire Oil and Gas Value chain is actively operated.

The state owned gas utility GAIL is currently owned by government with a 55% stake whose worth stands at Rs. 46,700 crore. In line with government’s expectations and building the nation’s gas infrastructure GAIL’s management feels that a tie-up with ONGC would be a more workable solution.

Key Pipeline Projects and Historic Stock Performance

The Jagdishpur- Haldia and Bokaro-Dhamra Natural gas pipeline (JHBDPL), which is targeted towards supporting 2,665- km long pipeline passing through UP, Bihar, Jharkhand, Odisha and West Bengal is foreseen as the next step in garnering industrial development in the North-eastern belt. This is one of the biggest City Gas Distribution network (CGD) being laid out by GAIL and will dramatically boost its operating margins.

GAIL’s stock performance has reflected immense potentials and the huge opportunities that lie in the gas sector is expected to provide consistency in the years to come. The company has managed to function with an operating profit margin of more than 10% on a YOY basis during the past decade which is a difficult feat to strike. Also the March tariff proposal by the Petroleum and Natural Gas Regulatory Board’s (PNGRB) set at Rs 2 per standard cubic meters has been accounting for improvement in profits for the firm.

Should you Sell?

For portfolio 2018, energy stocks can very well be expected to streamline their earnings and make for a Strong BUY. At current levels GAIL must be watched closely and entered whenever there’s a possible correction or a viable opportunity.

Disclaimer: The article is in no way an advice to buy or sell any stock; rather it provides a base for the investor’s own research. Consult with a registered investment advisor, prior to making any trading decision of any kind.