With Implementation of GST, Patanjali, that had witnessed robust sales growth in recent years, has slowed down significantly whereas (HUL) Hindustan Uniliver’s recovery has been faster. The fast moving consumer goods companies (FMCG) have delivered in line or better than expected performances for the fourth quarter ending March 2018.

All the major FMCG companies like Asian Paints, Dabur India, Marico, Nestle, Titan and Hindustan Unilever (HUL), have met the analysts’ estimates and delivered strong financial Performance.

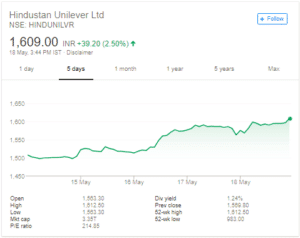

Hindustan Unilever has recently touched 52 week high level and delivered another strong performance for the quarter despite the cut throat competition. Further, the company has overtaken ITC with respect to market capitalization after 13 years.

HUL Performance in Q4 2018

Hindustan Unilever in the fourth quarter has delivered 14.2 percent growth in the standalone net profit to Rs 1,351 crore due to the trade conditions and higher consumption. This was in line with the analysts’ expectations. Its revenue rose 2.6% to 90.03 billion rupees during the quarter mainly due to the volume growth.

The company has reported 11 percent growth in the underlying volume growth. During the corresponding quarter last year, the volume growth was 11%, but then base for the company in the earlier quarter ending December had contracted by 4% due to demonetisation.

Moreover, the company’s EBITDA margin is up by 24%, driven by a strong savings program. In the Home Care segment there was double-digit growth across all key brands. Household Care growth was driven by strong performance in Vim.

In the personal care segment the company had double-digit growth across care and wash. Hair Care had delivered broad based volume led growth and the company launched Pure Derm, which is a new range of anti-dandruff shampoos The company has sustained a growth momentum for many quarters for Color Cosmetics.

During the year all the four segments have grown in double digit. Additionally, Kissan has also posted strong growth led by Ketchups. Knorr franchise has expanded with new Knorr Pasta masala variants being launched in select geographies.

In the Refreshment segment, there was robust growth across categories. Tea had sustained double-digit growth by differentially leveraging the portfolio across the country and also by accelerating the market development. Coffee has posted strong volume led growth.

Ice Cream and Frozen Desserts had also grown in double-digits due to the geographic expansion and exciting new launches including Kwality Walls Sandwich and Cloud Bite.

HUL Share Price Review

Post GST, HUL is better placed than its peers. Further, the volume growth prospects have improved and considering low base for the next two quarters HUL volume growth is expected to continue to be very strong.

Further, in the near term the company is projecting gradual improvement in demand and the company remains focused on profitability and growth. The counter claims of competitors such as Patanjali to hold the largest market share will be a daunting challenge for them.

Therefore, the investors should accumulate the stock and buy on dips with a target of INR 1700.