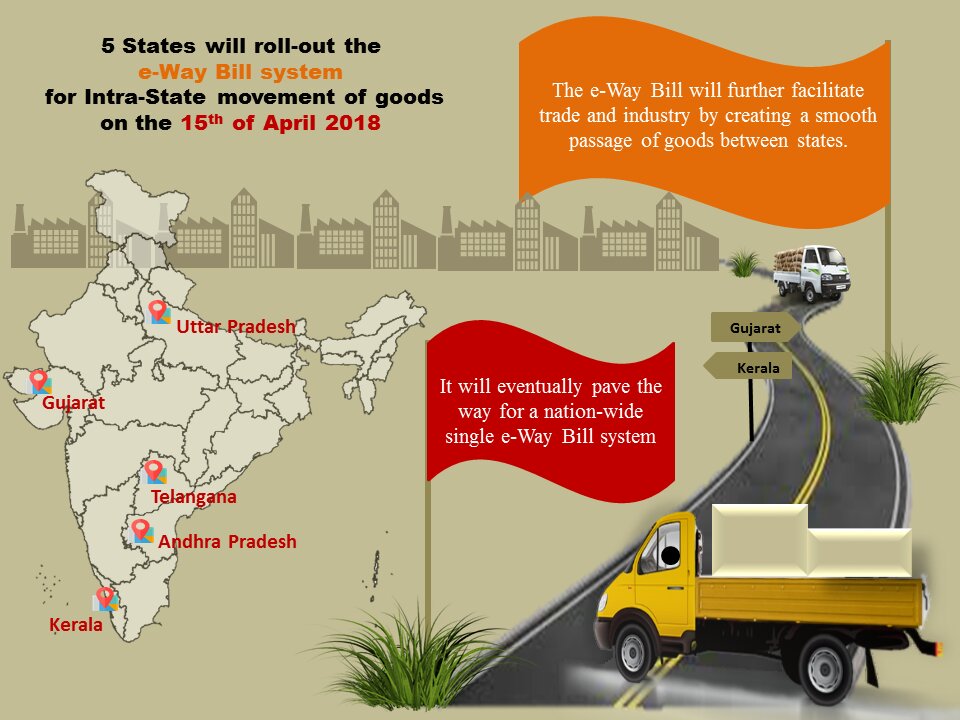

E-way bill required for intra-state movement of taxable goods valued over Rs 50,000 rolled out in 5 states as planned on 15th April, 2018. The 5 states that are covered include Gujarat, Uttar Pradesh, Andhra Pradesh, Telangana and Kerala. More states to follow starting 25th April, 2018.

Implementation of e-way bill

E-way Bill for interstate was finally rolled out on April 1st, 2018 including intrastate movement for Karnataka and on that day approximately 2.89 lakh such bills were generated in 24 hours.

However, even after the intra state roll out, there has not been a big increase in the generation of these bills, as only approximately, 2.4 lakh e-way bill (both inter-state and intra-state) were generated till 5 pm on 15th April.

The implementation is a big task and it was put on hold twice after the system developed temporary problems in generating permits. Other states will also start the generation of intra-state e-way bills as planned on the portal, but the system is having some problem for its implementation already though not big enough to halt the process again.

Is the E-Way Bill System Sustainable?

E-way bill has paved the way for a nation-wide single window system and to increase smoother trade. Through with this system there is an expectation to “ensure uniformity in the whole procedure of interception or conveyance for inspection of goods, detention, seizure, and release and confiscation of such goods and conveyances.”

The government has taken this step to boost tax collections and to reduce those trades that currently happens on cash basis. But looking at the numbers, it looks pretty difficult to expect the target being achieved very soon.

This system will also impact the local grey market movement of luxury consumer goods such as air conditioners, refrigerators, TV etc.

Low Compliance in GSTR Filling vs. E-Way Bill Generation

As per the data released by Finance Ministry in 2018 the compliance rate for filling GSTR 3B is hovering around 70% and the count of generation of E-way bill with 5 big manufacturing states coming under the scope seems to be very low. A bigger and correct picture would be available once all the states come under the system.

Overall, it seems that the e-way bill system is developed with an intention to build tax compliant and disciplined society but it may soon turn to more of inspector raj if compliance level falls. Therefore initially, it is necessary for inspectors to check the amount of trade and to remove the systematic illegal flow of goods travelling without all the requisite documents on cash basis in order to force the businessmen to comply with E-way bill system.

Pingback: Intra State E-Way Bill on 11 Commodities in Madhya Pradesh From April 25

Pingback: GST Annual Returns: 6 Things to keep in mind before filing!