MCX (Multi Commodity Exchange of India Ltd) stock has become very volatile these days. The stock has moved almost 8% in intraday today. As a result, SEBI has started preliminary investigation for its price volatility and has sought details about its trading.

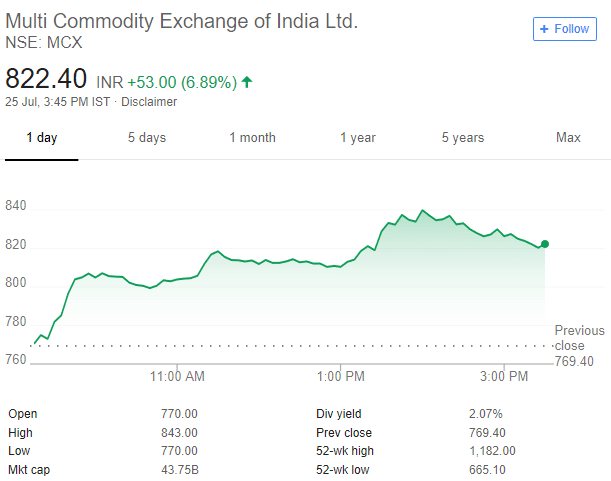

MCX Stock Price Movement in NSE

- Speculation on Merger with NSE

MCX and The National Stock Exchange (NSE) and Multi Commodity Exchange of India (MCX) are in exploratory talks to combine their operations and provide investors a one stop shop for trading in all kinds of products.

If this merger happens, then a bigger exchange will be created which will have everything from equity derivatives to commodity futures. Further, it is presumed that NSE has appointed Morgan Stanley while MCX is getting advice from JPMorgan. Meanwhile, SEBI has allowed the exchanges to offer all asset classes under one roof under the universal exchange guidelines from October 2018

- Weak First Quarter 2019 Financial Performance

MCX for the first quarter 2019 has reported PAT fell by 72% to Rs 7.33 crore f compared with Rs 26.30 crore in the corresponding quarter last year. This is much lower than the analysts’ expectation.

As a result, MCX stock fell about 5.5% on Monday. The profit is affected due to Rs.238 million of exceptional item, and 60% fall in other income. Further, the transaction revenue was weak (though grew 23% year on year) as the average realisation fell, however the company posted 30% year on year rise in the ADTV recovery momentum sustained to a level of Rs 240-245 billion. Additionally, the company has posted a one-time loss of Rs 23.8 crore due to a change in approach the commodity exchange uses for valuing its portfolio of tax-free bonds.

Chart of MCX Stock

(source: google finance)

Valuation – Should you Buy?

In the first quarter of 2019, despite decline in net profit, the analysts are still positive as the decline is mainly due to other income. Further, in Q1 2019, the income from the operations rose to Rs 72.9 crore during April-June quarter of the FY 19 from Rs 59.2 crore in the year-ago period. The company has also posted strong growth in the overall operating performance, as the average daily traded turnover grew approximately 30 percent to Rs 24,360 crore over the corresponding quarter last year.

Moreover, SEBI initiatives for universal exchange and to liberalise and strengthen commodity market will lead to company’s growth. As a result, the existing investors should “Hold” the stock.