Tata Motors has commenced bookings of its much awaited SUV, Tata HARRIER, from 15th October 2018. Amidst JLR crisis, Harrier is a new ray of hope for Tata Motors shareholders.

Tata HARRIER is based on the revolutionary architecture, which is derived from Land Rover’s legendary D8.

The SUV is gaining popularity, as over 1 million vehicles have been sold worldwide. The customers can book the Tata HARRIER with a small amount of INR 30,000 on www.tataharrier.com or can visit the nearest Tata Motors authorized dealership.

Tata HARRIER

Tata Harrier will have a new 2.0 liter Kryotec engine from Fiat Chrysler Automobiles Multijet II. The engine is expected to provide 140 PS power on the 5 seater Harrier. Tata Harrier plans follow Tata’s Impact Design 2.0 showcased at the 2018 Auto Expo in January this year.

Further, this SUV will be the company’s first offering in the mid size crossover segment. Tata Harrier, after being launched, will compete against the Hyundai Creta and Jeep Compasss.

Tata Harrier is planned to be priced between Rs 13-16 lakhs. Meanwhile, MG Motor, which is the British manufacturer owned by Chinese company SAIC have announced to launch a wide range of new products in India.

The first of these products is planned to be in mid sized C segment SUV which is scheduled to be launched in Q2 2019. This new SUV will be a rival to cars like Hyundai Creta, Tata Harrier and Jeep Compass.

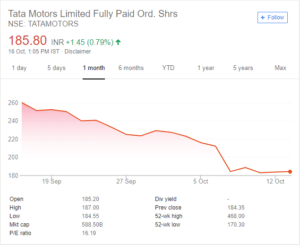

Tata Motors Stock Price Chart (NSE: TATAMOTORS)

Tata Motors stock is trading at a level of Rs.185.80, has a support at the level of Rs.182.50 and resistance at Rs.260. The stock has already touched the support level and has started rising. Over the past 12 months, the stock has fallen significantly.

Recently, the stock plunged by approximately 20% after JLR had shutdown its second plant for two weeks due to lower demand. JLR’s retail sales has declined 13.2 per cent between July and September due to a 46 per cent fall in Chinese sales. While the company’s close competitors Audi, BMW and Mercedes sales grew by 5-10 per cent.

Due to JLR’s falling consumer demand, the company has lowered production days at the Solihull and Castle Bromwich plants. There is an expectation that there will be a fall of 2-4 per cent in JLR’s volumes for FY19 from the earlier expectation of low single digit growth. JLR had already indicated that a hard Brexit may cost it $1.5 billion a year.

Meanwhile, JLR is raising fund of approximately $1 billion in the offshore loan market, to use the proceeds in its capital expenditure plan.

The existing investors could hold the position and new long term investors may accumulate the stock at this level with the price target of Rs.260.

Pingback: Ease of Doing Business: Real for Medium and Small Enterprises?