Infosys is anticipated to grow faster in the current financial year on the back of stellar performance in the first quarter and also due to the large deals that company got it which shows that the company will perform strongly in the future. The company’s performance has surpassed its strong competitor rival Tata Consultancy Services (TCS).

The company has also raised its revenue guidance and anticipates growth in the range of 8.5-10 per cent for the year from the 7.5-9.5%, driven by strong backlog though there is concerns over the rising rate of attrition. Further, the company has also reaffirmed EBIT margin guidance and expects it to be in the range of 21-23%. On the other hand, TCS expects to post double-digit growth for the second consecutive year.

Infosys & TCS: Current Performance

Infosys has reported 12.4 per cent growth in the revenue during the first quarter of this fiscal compared to corresponding period last year ago. This is significantly higher than the 10.6 per cent achieved by TCS. Infosys has secured large deals of more than $2.7 billion, which is highest ever in a quarter and has come mostly from clients in the US and Europe.

Infy’s net profit grew 5.3% in the first quarter on a year-on-year basis, though it has fallen by 6.8% sequentially to Rs 3,802 crore. The company had ended FY19 with total contract value of $6.28 billion. TCS’s net profit for the first quarter ended June 30 stood at 81.31 billion rupees ($1.19 billion) from INR 73.40 billion a year earlier. Revenue increased by 11% to INR 381.72 billion from INR 342.61 billion

Meanwhile, Infosys reported a higher attrition of 23.4 per cent, that also includes people being let off in the quarter, compared with 20.4 per cent in the previous quarter and 23 per cent during the corresponding period year-ago. The company has added 906 people (net) in the first quarter. The company’s higher attrition is on the back of seasonality as employees leave to pursue higher studies in the first quarter and higher involuntary attrition. In comparison, TCS has posted the attrition of 11.5 per cent in the first quarter ending June. The company has added 12,356 employees, which is the highest in the last five years.

Moreover, Infosys continues to face margin pressure. The operating margin stood at 20.5 per cent, got affected in the first quarter. This was lower by 100 basis points sequentially. The company, however, maintained its margin guidance and expected to range between 21-23 per cent for the financial year. TCS’s operating margin fell to 24.2% from 25% a year earlier.

Additionally, Infosys has also decided to distribute 85% of free cash-flows to shareholders through dividends and buybacks over a period of five years against 70% earlier.

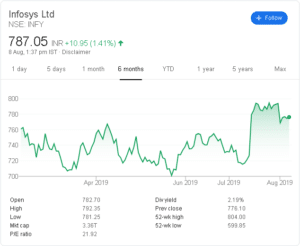

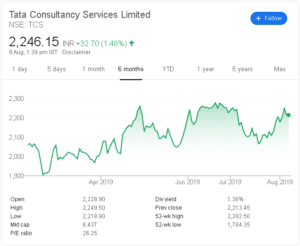

On the other hand, Infosys has a lower valuation compared to TCS. Infosys stock is now trading at a price-earnings (PE) multiple of 18.5 times to the estimated one-year forward earnings, against the TCS PE of 22.7 times.

Infosys Stock Price Chart (NSE : INFY)

TCS Stock Price Chart (NSE : TCS)

SourceGoogle Finance

Valuation of Infosys is low compared to TCS, which gives the investors opportunity to invest in the stock