After the spate of demonetization, the mutual fund market has become massive and the biggest game changer in the town. When investing in the mutual fund scheme you have two options- either to put a lump-sum amount or do it in a staggered manner using the SIP route. Many people consider SIP as an easy way for the wealth creation because it is a flexible way to invest. In this article, we will discuss about the best mutual funds 2017 so that you make an informed decision.

Best Diversified Mutual Funds 2017

When building a mutual fund portfolio it is important to check the past performance, but it is not a single barometer. It is also important to check the style and growth. Though diversification offers great returns but pointless diversification can invariably lead to losses. Kotak Select and Invesco India is one of the most rewarded diversified mutual fund in this category.

Kotak Select Mutual Fund

For the last 7 years the fund has offered the constant return of 14.51%, thus outperforming average and benchmark indices. The fund is backed by solid track record and comes under the category of large cap funds with an average AUM of Rs 15,194.8 crore. Here are the details of the same:-

| Period | 1 year | 2 years | 3 years |

| Return | 28.7 | 19.5 | 13.9 |

- Minimum amount that you need to invest-Rs 5,000

- Minimum SIP amount- Rs 1000

- Dividend- Rs 23

- Exit Load-1% if redeemed within 365 days

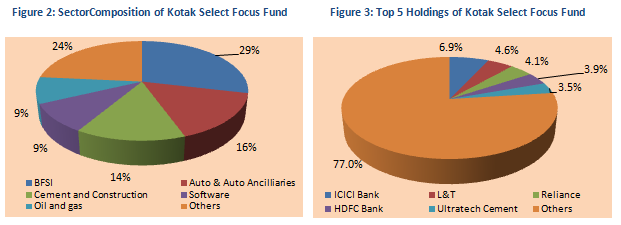

Fund investment portfolio

Source advisorkhoj

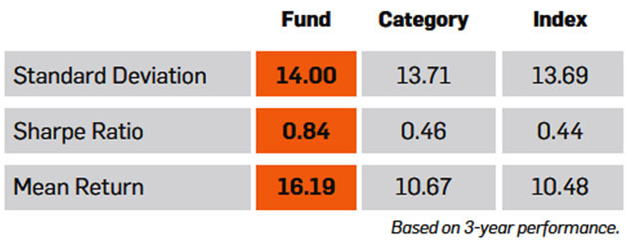

Risk Reward Analysis

The risk return ratio is superior as compared to its competitors. Here’s the chart showing that

Should the investor buy?

With the sharp increase in returns and impressive track record, the stock is worthy to pick. This is the best diversified mutual fund 2017.

Invesco India Dynamic Equity Fund

This fund is ranked at no 1 position by CRISIL. Heres the performance chart

- Minimum amount that you need to invest-Rs 5,000

- Dividend- NA

- Exit Load-1% if redeemed within 365 days

- Fund Type-Open ended

Returns (NAV as on 29 Nov, 2017)

| Period | 1 year | 2 year | 3 year |

| Returns (%) | 29.0 | 15.5 | 10.9 |

Fund Investment Portfolio

| Equity | Sector | Value (Rs cr) |

Asset % |

| HDFC Bank | Banking/Finance | – | 8.96 |

| Reliance | Oil & Gas | – | 7.15 |

| Maruti Suzuki | Automotive | – | 6.50 |

| Kotak Mahindra | Banking/Finance | – | 5.31 |

| IndusInd Bank | Banking/Finance | – | 4.97 |

| Hero Motocorp | Automotive | – | 4.97 |

| Tata Steel | Metals & Mining | – | 3.54 |

| Interglobe Avi | Services | – | 3.30 |

| Motherson Sumi | Automotive | – | 3.30 |

| Bajaj Finance | Banking/Finance | – | 3.14 |

Should you Buy?

If you want to generate long term wealth through equity and equity related instruments, this fund is worth a pick.

Best Tax Saving mutual funds 2017

There is various equity linked savings schemes that offer the investors to save tax. These funds help the investors to invest in equities and they can choose either dividend or growth option. What makes this scheme standalone is they have the shortest lock in period as compared to PPF with 15 years, National Pension Scheme with 60 years. You can hold the mutual funds for three years or sell it if it is not in sync with the expectations. Birla Sun Life is the best example of it.

Birla Sun Life Tax Relief 96

December is a scary month because in this month the employees have to submit proof of investments, else tax would be skimmed in the coming months. With ELSS, you can save upto 1.5 lakh of amount under section 80 C. Birla Sun Life mutual fund is one of the best tax saving mutual fund that gives the investors to earn great returns over the long run. Heres the analysis for the same!

Return Analysis

The fund follows a multi-cap strategy, wherein it invests 55-60% of amount in large cap funds and rest in small and mid cap. Below are the returns as on 30.07.2016

| Period | 1 year | 2 years | 3 years |

| Returns (%) | 37.8 | 20.8 | 17.3 |

Should you Invest?

If you have invested in this scheme, we advise you to stay invested in it as CRISIL has ranked this scheme as no 2 in ELSS category.

Best Infrastructure Funds 2017

The investment is infrastructure funds are made to meet the long term financial objectives. While developing infrastructure has become priority for the government, it makes sense to invest in it. L&T is a best example of it.

L&T Infrastructure

This is one of the best infrastructure mutual funds 2017. This scheme aims to generate capital appreciation by investing primarily in the area of infrastructure.

| Period | 1 year | 2 years | 3 years |

| Returns (%) | 44.9 | 32.2 | 23.3 |

Should you Invest?

If you have invested in this scheme, you may continue to stay in this scheme. This scheme has ranked no 1 in Thematic Infrastructure by CRISIL.

Best Midcap Mutual Funds 2017

In the recent times, the midcap mutual fund schemes are offering tremendous returns to the investors. The best example of it is:

Mirae Asset Emerging Bluechip Fund-this fund will help you to achieve your financial goal.

| Fund | Returns (%) | |

| 1 year | 3 years | |

| Mirae Asset Emerging Bluechip Fund | 23.24 | 23.73 |

| Principal Emerging Bluechip Fund | 20.89 | 21.26 |

| L & T India Value Fund | 20.69 | 19.84 |

Should you Buy?

This scheme is ranked at no 2 position by CRISIL. If you have invested in this scheme, we suggest you to continue with. But do keep a tab on its performance.

Parting Thoughts

These mutual fund investments can deliver high returns if chosen carefully. However, as we always advocate the investment should be made in good performing schemes based on your time frame and risk appetite.