The Union Budget 2018 will be announced soon. With more reforms coming across various sectors, best stocks to buy could be Bharat Electronics Ltd. (BEL), Everest Industries and Gujarat State Fertilizers & Chemicals Limited.

Next year is election, so the budget is expected to be populist one. However, the market is at peak, so one should buy with the stop loss.

Why Best Stocks to Buy Before Budget 2018?

Bharat Electronics Ltd. (BEL) specialized to meet electronic equipment requirements of the Indian Defence Services. Everest Industries expects to get the advantage from Infrastructure boost. The third among the best stocks can be Gujarat State Fertilizers & Chemicals Limited, who will get benefit from agriculture boost.

Bharat Electronics Ltd. (BEL)

Favorable policy changes by the government in the defence sector in last three years has worked well for BEL as 88% of its revenue comes from the defence segment. BEL has given consistent growth over last 5 years, despite muted growth in defence capex. There is an expectation of higher defence capex in coming years post completion of OROP and seventh pay commission implementation. BEL would be a key beneficiary of higher defence capex and favorable policy changes implemented by the government.

BEL’s order book has almost doubled in FY17 to ~Rs. 40,000Cr (4.7x TTM Sales) which provides great revenue visibility for next three years. The increase in the order book was led by large orders like IACCS (Integrated Air Command and Control System) and Advanced composite communication systems. The management is optimistic of receiving order inflow of Rs. 13,000Cr-15,000Cr per year over next three years. It is expected that order book will grow at 8% CAGR over FY17-FY20E due to the higher defence capex and pick up in export order book.

The target price for BEL is INR 220, with the investment horizon of 6 to 12 months.

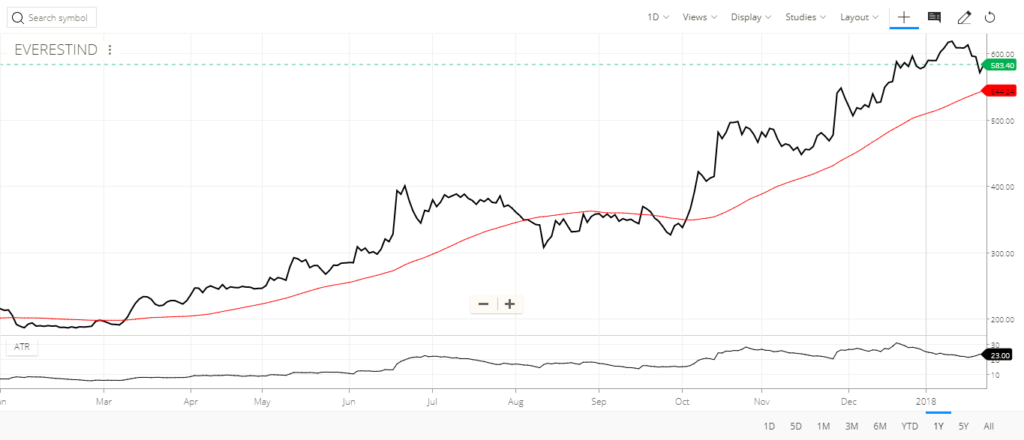

Everest Industries Ltd (EVI)

Everest Industries Ltd (EVI), a roofing company but by FY20 65% of its profits will come from newer building products and pre-engineered steel buildings (PEB). In FY17, roofing/ boards & panels/ PEB accounted for 49%/ 15%/36% of its revenues. Over FY17-20E it is expected EVI’s CAGR of revenues/ EBITDA/ PAT to be 11%/ 53%/173%. The EBITDA margin expansion and debt repayment will further help EVI to post ROE and ROCE of 16% and 22%, respectively, by FY20.

The target Price for EVI is Rs 700, with the investment horizon of one year.

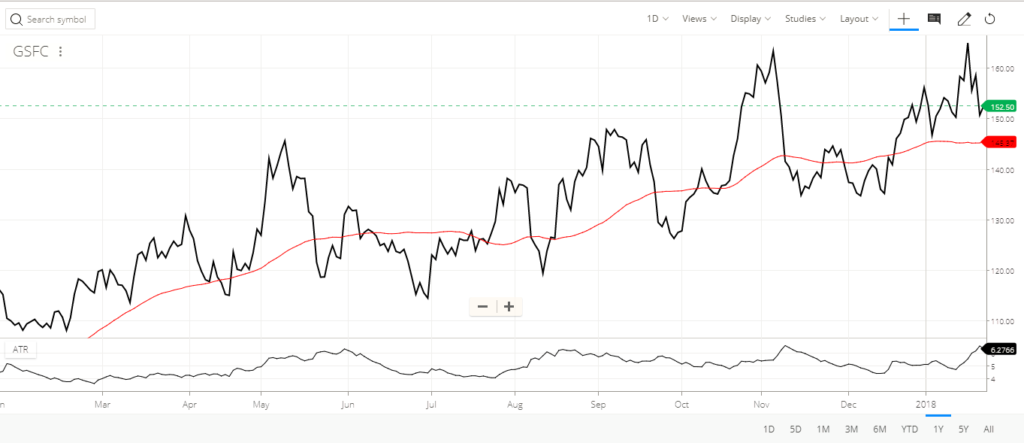

Gujarat State Fertilizers & Chemicals Limited (GSFC)

GSFC has planned to increase its production capacities for Phosphoric Acid, Sulphuric acid, caprolactam and MMA at different locations in Gujarat. Fertilizer volumes largely driven by healthy increase in DAP/Complex Fertilizer volume growth. The management has also stated that it will do higher trading this season especially in non-core markets in order to increase its market share that will drive overall growth

The target Price for GSFC is Rs 187, with the investment horizon of 6 to 12 months.

With the really we have seen in past few days, investors must smartly identify the best stocks to buy and take advantage of the post budget rally opportunity.

Disclaimer: The article is in no way an advice to buy or sell any stock; rather it provides a base for the investor’s own research. Consult with a registered investment advisor, prior to making any trading decision of any kind.