Bitcoin (BTC) Price has failed to reach the level of 10,000 and the cryptocurrencies are falling continuously. BTC has experienced three major corrections in 2018. There are lot of tokens and small cryptocurrencies that have followed the price trend of bitcoin and Ethereum.

Bitcoin Price Analysis

Analyst Willy Woo, a cryptocurrency and digital asset analyst, expects that BTC could fall to the level of $5,000 region. He expects that if the BTC price falls below the $6,500 level and fails to sustain the $6,800 support level. Therefore, Bitcoin price could move to the lower end of $6,000 and potentially to the higher end of $5,000. This is based on the observation on May 25th, where WOO analysed that bitcoin price is expected to dip below the $6,000 level and test $5,500 to $5,700 as a long-term support level.

His analysis is based on:

- High NVT (Network Valuation divided by Transaction Value) signal

- Volatility is still too high

- Standard NVT is overly high

- Volume Profile cliff is below $6,800

Bitcoin Price Chart

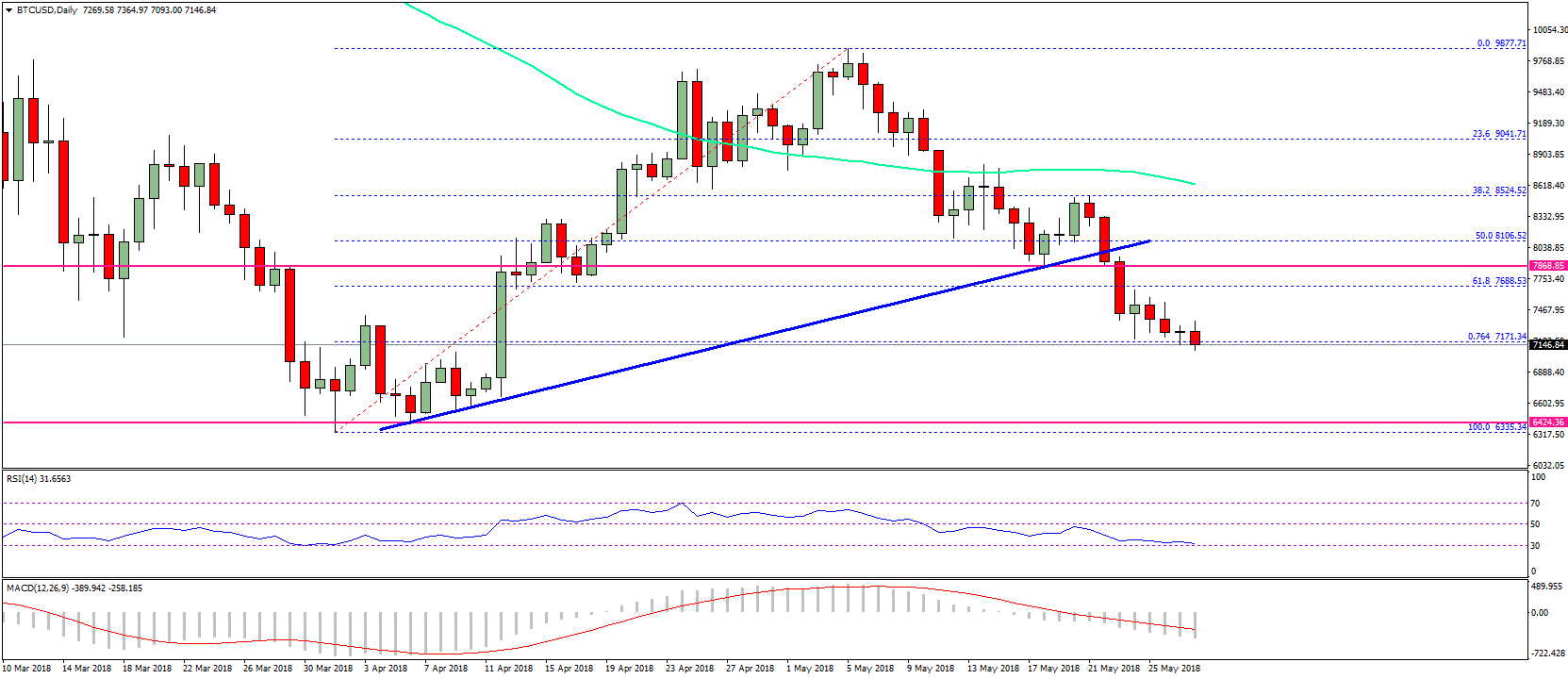

BTC price fell from the level of 9877.10 to the first support level of 7068.05. Further, BTC broke the first support level and expected to fall to the second support level of 6335.34. The green line is 100-day SMA and since the price is below this line, it is expected that price will be not sustain up unless it crosses the 100-day SMA from below towards up. This signals that the selloff is more likely to continue than to reverse.

Therefore, BTC price is hovering at the major support zone, and bulls requires more momentum to sustain a bounce.

Future of Bitcoin Price

The short-term downtrend of the Bitcoin price channel remains intact. An upside break could prevent the fall in the bitcoin price. This is due to the fact, that the BTC lack positive updates and the liquidation of more BTC on Mt. Gox have led to declines. Moreover, the trade talks and political uncertainties, have dampened the sentiments of the investors. However, the positive news regarding the regulation could lead to positive outbreak.

Moreover, due to the difference in the volume and structure of the cryptocurrency market in comparison to 2017 and previous years, both Woo and other analysts in the cryptocurrency sector have agreed that the next bull rally or up cycle for bitcoin will take less time to initiate, possibly in the third quarter of 2018.

Pingback: Bitcoin Price Analysis: BTC/USD Recovers After SEC Clarification