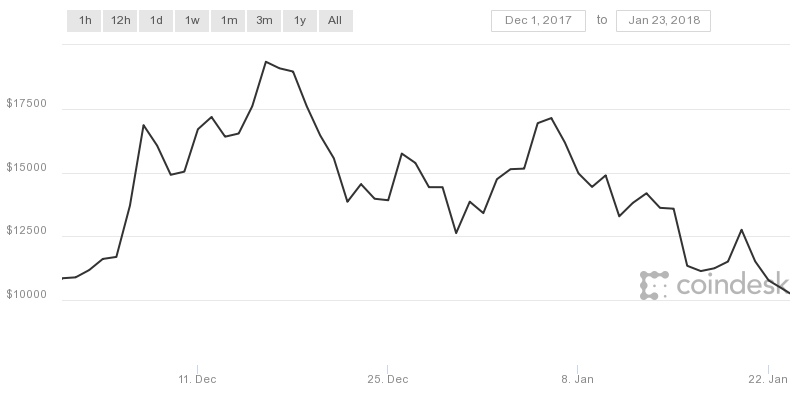

Bitcoin investors are not very happy these days with the changing mood of Bitcoin price charts. After a giant rally noticed post second half of December, BTC/USD has struggled to maintain the high levels and is trading with a range of 10k – 15k in 2018.

Bitcoin Price Plunge

Major reason of this sink is South Korea. Trading of cryptocurrency happening from anonymous bank accounts have been banned by the government of South Korea. These rules will be in effect from January 30. Another report says that children below 19 years will not be allowed to buy Bitcoins and even the foreigners not holding local bank accounts will be allowed to trade.

Bitcoin Trading in India

Indian regulators are brainstorming since various months across different forums on the legal framework to govern cryptocurrency market. There had been cautions/advisory issued by the government from time to time calling cryptocurrency market as a ponzi scheme.

Government Cautions People Against Risks in Investing in Virtual ‘Currencies’; Says VCs are like Ponzi Schemes https://t.co/uNL3NqUG5c

— Ministry of Finance (@FinMinIndia) December 29, 2017

Though the legality of trade is not yet certain, rising craze of cryptocurrency is becoming a matter of concern for the government as the volatility in the instrument is very high. Investor’s protection is at risk.

What if India Bans Cryptocurrency Trading?

Recently, various banks in India took call to freeze bank accounts of cryptocurrency exchanges operating in India as the value of Bitcoin continued to plunge. There are various reports which say that both public and private banks participated in this exercise.

The exchanges affected by the steps taken by the Indian banks are Unocoin, Zebpay, Koinex, CoinSecure and BtcxIndia. The cryptocurrency industry is adding 200,000 users in India every month. For the few accounts that are still open, the banks have asked the Bitcoin investors for more collateral, and have capped the cash withdrawals.

On the other hand, tax authorities also sent some notices to cryptocurrency traders, these notices were more towards recognizing the source of funds for investments and ensuring point of taxation of the capital gains.

Soon India may do what South Korea just did. The major concerns for Indian government are investor protection and money laundering threat. Government does not want to take any call in haste and discourage the investors whose money is already at risk.

As per Bloomberg Report, India stands at #10 in terms of year to date growth of peer-to-peer Bitcoin trading.

Co-founder and CEO Sathvik Vishwanath says

“It took us about three years to gather [100,000] registered customers and in last one month itself we have seen about [200,000] customers registering with us.”

Zebpay co-founder Sandeep Goenka said that interest of investors is phenomenal. He also said that the number of users have increased by 300,000-400,000 in the past few months compared to around 150,000 in June and July.

There are more than 11 leading bitcoin trading platforms in India, If India Bans Cryptocurrency Trading or Bitcoin trading then there will be another plunge in Bitcoin prices and other cryprotcurrencies as well. For now, government is trying to keep track of investors, their source and utilization of funds and income tax profiles.

Pingback: Bitcoin, Cryptocurrencies Ban in India Misinterpreted in Budget 2018

Pingback: Bitcoin Decline Extends, Market Awaits SEC Decision

Pingback: Modi Cabinet Clears Chit Funds and Unregulated Deposits Bill for Investors