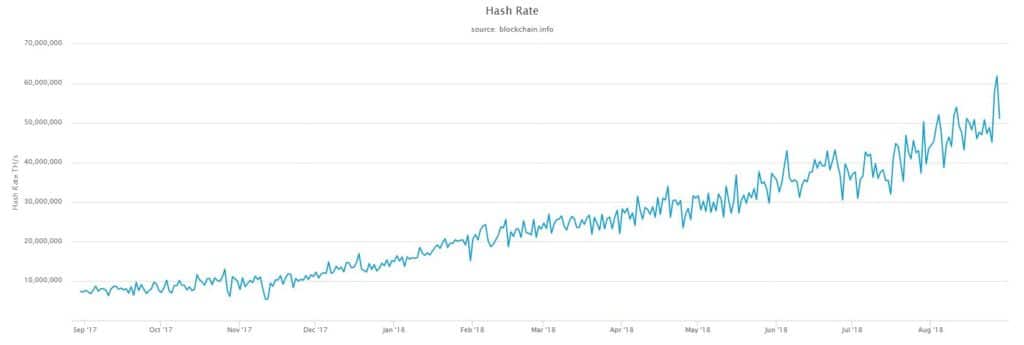

It has been observed that the Bitcoin price has been rising along with the increase in the hash rate since last December. However, this correlation stood corrected when the price of Bitcoin and altcoins had fallen by more than 60% and 90% respectively even when the hash rate had spiked by 150% over the last six months.

Hash Rate is an important determinant in the prices of Bitcoin globally. It is a measure of “how much power” is used to create a block in the normal mean time of 10 minutes. This power is used to solve the mathematical proof-of-work to create a block. The number of attempts made per second to create this block is deemed as the hashes per second(H/s)

The world of Bitcoin is reeling with a 35% hike of hash rate over the last 2 days and a 50% hike over the last month. In June the rate stood at 43 quintillions, July – 50 quintillions and August has surpassed that by 50% with 60 quintillion hashes per second.

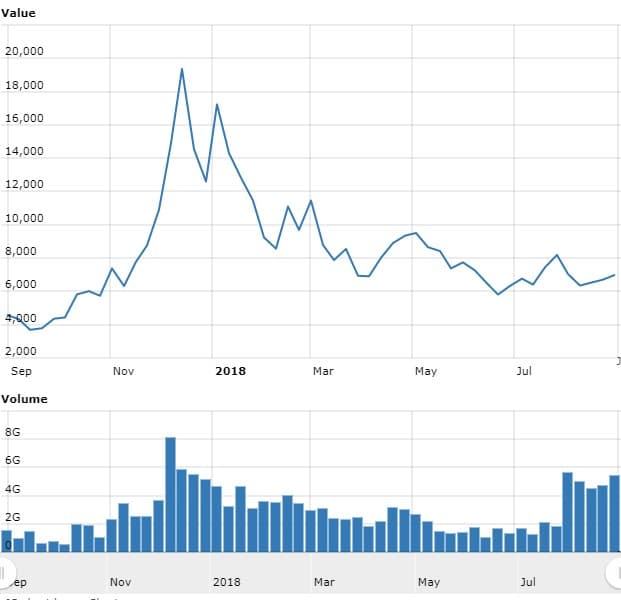

Between May and June 2018 one can still talk about a correlation between the price and hash rate with the recovery in Bitcoin price encouraging more players to jump in mining. However, the sharp fall in prices in early June 2018 pushed the miners to adjust their cost of mining steeply.

However, since the specific critical mass of hash rate is required to allow the network to run smoothly to deter transaction delays, the prices have not yet dropped significantly to stop that critical mass from being profitable.

Bitcoin Price

HASH RATE

Bitcoin Price Pediction

The staggering rise in prices of mining equipment has not deterred the new entrants in the mining industry. Financial analysts like Max Keiser had predicted a 60,000 quadrillion calculations per second.

New ATH. 60,000 quadrillion calculations per second. Unstoppable. New ATH incoming. #Bitcoin pic.twitter.com/wL64hHHAtO

— Max Keiser (@maxkeiser) August 28, 2018

He also predicted the Bitcoin price to touch $28,000 in another of his tweets.

Based on my HR analysis, new ATH incoming. $28,000 still in play. pic.twitter.com/hYgPti1cqn

— Max Keiser (@maxkeiser) August 28, 2018

Another Analyst by the name of @CryptoHamsterIO from Japan, has given an analysis on Bitcoin touching a price of $530,000 by Deccember 19, 2019. Before that he expects an ATH of $21,000 on December 11, 2018. He has extrapolated the futures prices based on normal price data since 2003. He gives a clear indication of HODL.

A crystal ball prediction enhanced with some math:

next ATH – on Dec. 19, 2019, and the price will reach $530k.

the first update of the ATH – at $21k on Dec. 11, 2018 (again!?).

Intermediate peaks and correlations are calculated too.#bitcoin #btc #cryptocurrencies #crypto pic.twitter.com/N4SdIPFNwb

— CryptoHamster (@CryptoHamsterIO) 22 August 2018

Pingback: Ethereum Price Analysis: ETH/USD Near Significant Juncture