November 08, 2017 will mark one complete year since demonetization when notes of 500 and 1000 rupees went out of tender. Here is a brief putting light on its success and failure.

Willpower of Modi Government to Curb Corruption and Black Money

The factual data for common people become irrelevant when some big decisions are taken by the government. The demonetization drive was one such move that was welcomed by the common people. People accepted the problems they faced while standing in queue but they supported the government. The Union Government got its referendum on demonetization in the elections of UP where BJP won a historic 325 seats. As of June 2017, notes with value of Rs 15.28 lakh crores returned back to the banks as per RBI’s annual report. The total specified bank notes were 15.44 lakh crores on November 08, 2017 and the total currency notes in circulation were Rs 17.77 lakh crores.

Action on Black Money, Exposing Shell Companies and Attesting Properties under Benami Act

Out of 17.77 lakh crores of money that were in circulation prior to demonetization is now reduced to 83% counting Rs 14.75 lakh crores as of August, 2017. Here are some points to explain the observations:

- Rs 16, 000 crores didn’t returned to the bank.

- 73 lakh cases were identified where deposits do not match the tax profile of the depositor.

- Amount worth of Rs 3.68 lakh crore is under suspicion from 23.22 lakh bank accounts

- An additional 4.7 lakh bank transactions were reported by bank and financial institutions as suspicious.

- Undisclosed income worth of Rs 29, 213 crore was detected and admitted.

- Benami Sampatti worth Rs 1626 crore detected and attached by agencies.

The demonetization drive also exposed shell companies that were operating under Hawala racket by black money hoarders. 2.24 lakhs shell companies were struck off by the government who were operating with series of bank accounts. Some companies had around 100 of bank accounts while one company was detected with 2134 bank accounts. One company was acknowledged that had only 63.60 lakh rupees in its account before Demonetization but it deposited Rs 18.28 crores and withdrew Rs 18.68 crores in the course of DeMo.

Rise in Tax Base and Push towards Digital India

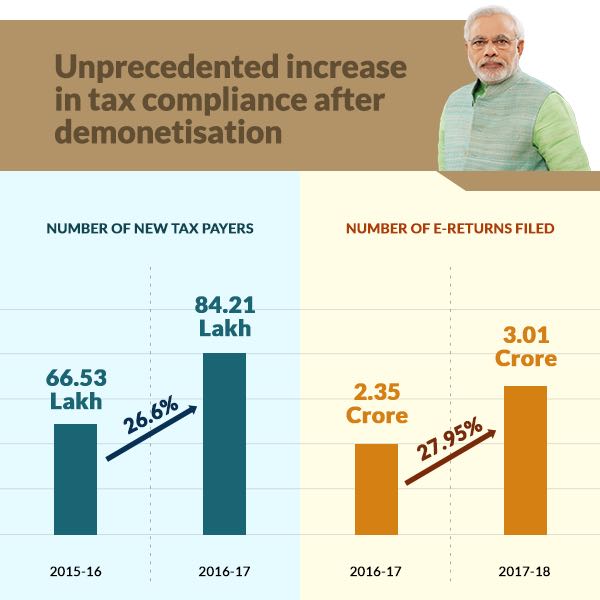

After DeMo there was a surge in tax base. The tax base that stood at 66.53 lakh tax payers in 2015-16 surged to 84.21 lakh tax payers in 2016-17. There was an unprecedented rise of 26.6% in the rise in number of tax payers. On the other hand, there was 27.95% rise in E-fillings. E-fillings that stood at 2.35 crores in 2016-17 increased to 3.01 crores in 2017-18.

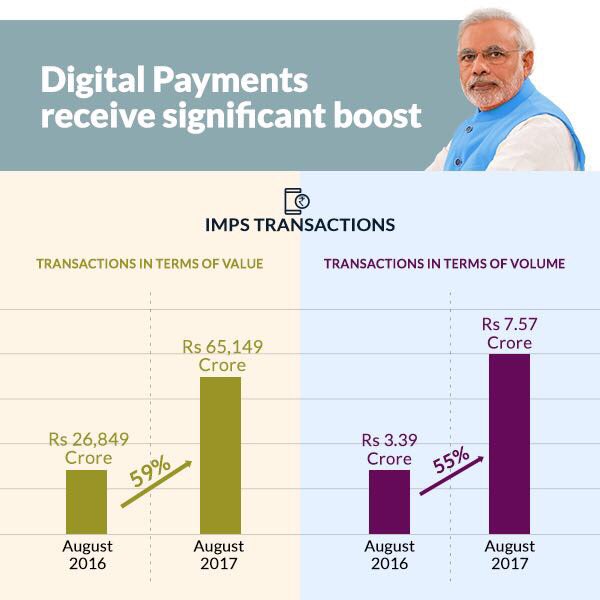

Digital payment also got a huge push during and after DeMo. In August 2016, 13.05 crore transactions took place while in August 2017, 26.55 crore transactions took place with a record 50% rise. 13 lakh new POS machines were added in last one year compared to the total of 15 lakh POS machines used since its start.

Some Relevant Questions against DeMonetization

Demonetization was executed to uncover the un-categorized black money in the form of cash but it failed to give the desired result in simple terms. The government says that 3.68 lakh crores of money is in suspicion but no significant action has been taken so far that many sound satisfactory. The other aim of DeMo was to reduced cash usage but as of now, Rs 14.75 lakh crores of new notes are in circulation, 17% short of the previous value.

These are relevant questions that the government has to answer as it is celebrating the DeMo Drive calling it Anti-Black Money Day.

Pingback: Modi's Magic - Moody's Upgrades India's Rating After 14 Years