In a major move to consolidate the banks, the government has announced the merger of Bank of Baroda, Vijaya Bank and Dena Bank, which will create the third largest lender in India.

Bank of Baroda & Vijaya Bank shareholder will lose from this deal but the shareholders of Dena Bank will get benefit from this merger.

Fundamental Analysis

It is important to be seen after merger the shareholders will get shares at what swap ratio. Considering the financials of the three banks the swap ratio of 1:8:5 seems to be appropriate. Bank of Baroda has net profit of Rs.203 cr, Dena Bank has loss of Rs.721.71 crore and Vijaya Bank is having profit of Rs. 144 crore.

Therefore, with this merger the Bank of Baroda shareholders will lose the most and Dena Bank shareholders will gain the most. Further, Dena Bank is under the scrutiny of Reserve Bank of India (RBI) for more than four months, as the bank has pile of bad loans.

Further, the portfolio of Bank of Baroda is more diversified across the industries compared to Vijay Bank and Dena Bank. Both Vijaya Bank and Dena Bank have high exposure in infrastructure.

Moreover, if the swap ratio announced in favour of Dena Bank, the government will gain the most as it has 80% stake in the bank. In Bank of Baroda, the government holds a lower stake of about 64%.

As per Moody, the merger would be “credit positive”. The merged entity based on March data, would have market share of approximately 7.2 percent in deposits (second largest) and 6.8 per cent in loans (third largest). Though no deadline has been defined for the merger, Moody is anticipating it to be completed by the end of the current fiscal year.

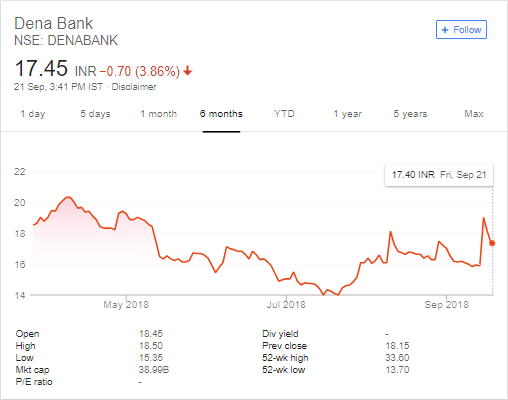

Dena Bank and Bank of Baroda Stock Price Analysis

After the announcement of the merger, Dena Bank stock reacted positively while other two banks’ stocks reacted negatively to the merger. Dena Bank has support at the level of Rs. 14 and resistance at Rs.20.4. Bank of Baroda has support at the level of Rs.112.30 and resistance at Rs.135.40

Dena Bank shareholders should hold the stock as they are expected to benefit the most. The merger is expected to strengthen the issues regarding the minimum capital requirement, corporate governance etc. The shareholders can reap the benefit in the long term only as there will be issues in the short term.