Edelweiss Retail Finance, a leading Non-Banking Financial Company in India, will be launching its public issue of secured and redeemable non-convertible debentures (NCDs) from March 7. The issue will be closed on March 22nd, unless the company decides to close it prematurely, either due to oversubscription or due to any other reason mentioned in its offer document.

Size & Objective of the Issue

Edelweiss Retail has planned to raise Rs. 500 crore from this NCD public issue, including the green shoe option of Rs. 250 crore. The company will use the funds raised of at least 75% for its lending activities and to repay its existing loans. Up to 25% of the proceeds will be used for general corporate purposes.

Coupon Rate & Tenor of the Issue

The company will issue its NCDs for a duration of 3 years, 5 years and 10 years. For 3 years, the company is offering 8.75% p.a. payable annually and 8.42% p.a. payable monthly. For 5 years, the coupon rates are 8.65% p.a. and 9% p.a. and for 10 years, these rates are 8.88% p.a. and 9.25% p.a. respectively.

Minimum Investment

The investors are required to apply for a minimum of ten bonds of Rs. 1,000 face value in this issue, which means an investment of Rs. 10,000 minimum.

Categories of Investors & Allocation Ratio

Category I – Institutional Investors – 20% of the issue, which means Rs. 100 crore

Category II – Non-Institutional Investors – 10% of the issue, which means Rs. 50 crore

Category III – High Networth Individuals (HNIs) – 20% of the issue, which means Rs. 100 crore

Category IV – Retail Individual Investors & HUFs – 50% of the issue, which means Rs. 250 crore

Meanwhile, Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others cannot take part in this issue.

Moreover, the Allotment will be made on a first-come first-served basis, as well as on a date priority basis

Credit Rating & Nature of NCDs

CRISIL and ICRA have rated this NCD issue as ‘AA’ with a ‘Stable’ outlook.

Return on NCD vs. FD vs. PPF vs. Other instruments

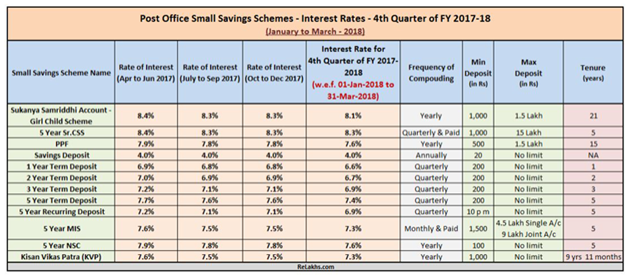

The interest rates on Bank fixed deposits have touched the lowest levels. Further, the interest rates on popular small savings schemes are not very attractive either. Tax Free Bond Issues are not available currently now. NCDs are one of the fixed income options that give investors’ a better yield and return

Moreover, SREI Infrastructure Finance 9.50% Non-Convertible Debentures (NCDs) was offered in February 2018 to the public.

Should you invest in Edelweiss Retail Finance NCD?

The company from last few years is earning good profits and is increasing year on year. The topline is also growing, which means strong capabilities. The offer has an attractive interest rate of 9.25%.

However, the investors, with a higher risk can go for investing in this NCD issue, but only for the shorter duration either 3 years or 5 years. Investing for 10 years with a private issuer is not good and should be avoided.