Indian Rupee (INR) have fallen to a level of 68.98 against US Dollar (USD) and is among the worst performing currency in 2018. INR is the second-biggest loser in the BRICS group: Brazil, Russia, India, China, and South Africa after Russia. INR has fallen due to wider trade deficit, surge in oil prices and capital outflows.

The experts are predicting that the worst is yet to come and INR might breach the 70 level. The Government tries to control the value of INR against dollar as it is a matter of political issue.

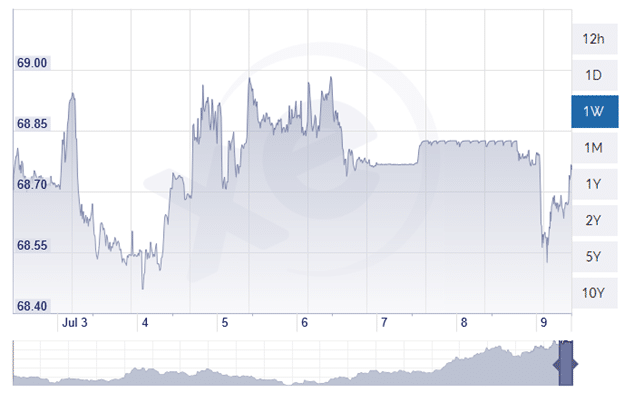

USD/INR Chart: Declining Indian Rupee

USD/INR during the week has made a high of 68.98 level and closed at 68.76 level. Therefore, the whole week, Indian rupees stood above 68 level. However, today the INR recovered by 30 paise but overall weakness remains.

Indian Trade Deficit

The trade deficit has widened as the import bill is rising and the exports’ contribution to the country’s GDP has reached a 14-year low. For FY 18, India’s import value has exceeded its net exports, by $156.8 billion compared to $105.72 billion in the last year.

This means India spent substantially more dollars in buying merchandise from other countries than it earns from selling goods and services across borders, leading to a weaker rupee. The trend of rising imports, and slow exports, will increase the current account deficit. This will also have an adverse effect on the stock market.

The foreign investment in Indian equities and bonds have slowed down. As per National Securities Depository Limited, the foreign portfolio investments stood at Rs. 13,260 crore.

Surge in oil prices

India’s approximately 80% fuel needs are met by imported crude oil. Global crude oil prices had breached the $80 dollar mark, which is putting pressure on the Indian rupee. In the past 12 months, the crude oil prices have moved up by 50 per cent, due to the supply cuts from major oil producing countries. This has also led to increase in domestic retail inflation. Moreover, the demand for fuel is increasing which is putting extra pressure on the INR.

Depreciation in the value of rupee will lead to rise in the bond yields and may force RBI to raise the interest rates. This will affect the loan borrowers. As a result, home loan EMIs could go up, the foreign travel and foreign education expenses is also expected to increase. Inflationary situation along with higher EMI would affect the economy adversely. The government can cut excise duty on petrol and diesel, but not able to harness the free fall in the rupee.

However, the situation has improved from 2-3 days, as the oil prices have stopped falling and INR improved slightly. Overall, the pain remains and INR can cross 70 mark.