In a bid to generate employment, the government of India started with a landmark initiative linked with EPFO known as Pradhan Mantri Rojgar Protsahan Yojana (PMRPY) in August 2016, but it failed to generate traction among the corporate world due to lack of awareness as only 6% of the total establishments are availing benefit of the scheme.

PMRPY Scheme

This scheme has been deployed for the employers to encourage employment for the new-age workforce. In this scheme, initially government contributed 8.33% (EPS) contribution for employers but now government will be paying the 12% EPF+EPS contribution of the employer.

The scheme acts as double- edged sword. On one hand, the employer will get incentives for generating the employment and on the other hand, the workers will be able to find the new jobs.

“Government of lndia will pay the full employer’s contribution (EPF and EPS both) w.e.f. 01.04.2018 for a period of three years to the new employees and existing beneficiaries for their remaining period of three years through EPFO.”

This means the government of India will contribute to employer’s contribution for the first three years from the date of registration of the new employee. Employees who have joined this scheme after 01 April 2016 having a UAN are covered under the purview of this scheme.

Beneficiaries under PMRPY scheme?

This scheme is meant for the establishments which are registered under EPFO scheme to avail the benefits and the corporate should have registered under PMRPY portal. The employee should have a valid Aadhaar card number and gross wages less than or equal to Rs 15,000.

A special incentive was also offered to generate the jobs in the textile sector in the beginning. Further to incentivize woman employment in the formal sector, the woman contribution under the PF act has been proposed to be reduced from 12% to 8% for the initial 3 years of employment.

PMRPY – Report Card

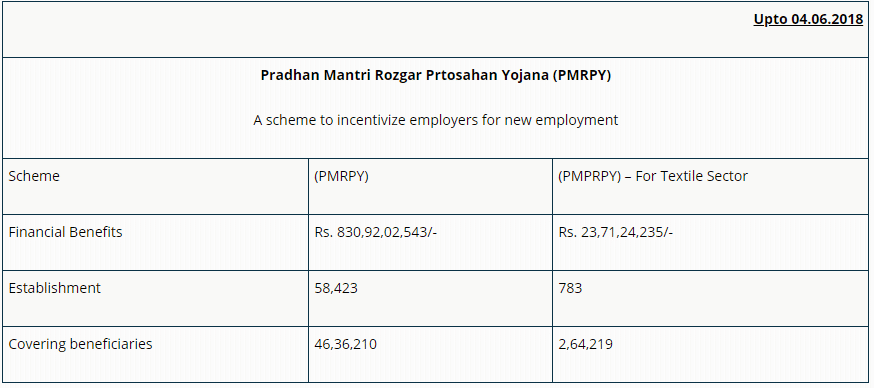

Since the implementation of the scheme i.e. July 2017, around 46 lakh workers have been benefited. This scheme will further help to achieve the target of generating 1 crore new jobs in the market and the government plans to increase the budget from Rs. 2500 crore to around Rs 6500-Rs 10,000 crore.

Source: Labour Ministry

Till date, the government has pumped in Rs. 830,92,02,543/- under this scheme and Rs. 23,71,24,235/- is offered to the textile sector. Out of 9,23,176 establishments registered with EPFO, only 58,423 establishments has been covered out of which 783 are in textile domain. The total employment generated between July 2017 – May 2018 under the scheme is 46,36,210 out of which employment in textile sector stands at 2,64,219

Awareness of the scheme

Though the scheme is highly beneficial to generate the new age employment, but it seems that due to lack of awareness, the corporate sector has not given it a warm welcome. This scheme will also help employers to curb evasion in EPF compliance as employers do not have to bear the burden of EPF. So in the end, we urge the employers to make the most out of this scheme and make India unemployment free.

Pingback: Employment Outlook of India: Reality or Hoax?

Pingback: Union Budget 2019 Live Updates: Last Opportunity for Modi Government

Pingback: ESI Contribution Rate Reduced, Relief for Employees and Employers