Tata Motors sales surged higher in June, with turnaround strategy in place, the stock price is expected to move higher.

Tata Motors has become the number 3 passenger vehicle maker in India in June. The company is behind Maruti Suzuki and Hyundai, which are market leaders in this segment. The company has sold 18,213 units in June, which is huge rise of 63 percent in comparison to the numbers of June 2017 when Tata Motors had sold only 11,716 units. This is due to the strong demand for Tiago, Tigor, Hexa and Nexon.

In June, the combined production of Tiago and Tigor crossed the important landmark of 200,000 units. Tata Motors’ recent launch Nexon AMT has witnessed strong demand as it received an overwhelming response in the market.

Further, the company for the first quarter 2019 has delivered a strong growth of 64% in its domestic sales of 164,579 units compared to 100,141 units over previous year. The exports of commercial vehicle and passenger vehicle grew by 50% to 5,246 units compared to 3,504 units last year.

Additionally, the company last year’s sales of commercial vehicle was affected due to the Supreme Court ruling on BSIII to BSIV transition. In June, the company continued to witness strong sales due to growth in economy driven by improved industrial activity, robust demand in private consumption and government spending on infrastructure. In addition, the implementation of GST has led to rationalization of the warehouses leading to faster turnaround time and giving a boost to the demand.

For FY 19, Tata Motors has three clear objectives, which includes ‘Win Decisively in CV’, ‘Win Sustainably in PV’ and embed the turnaround culture within the organisation. This turnaround journey is led by Guenter Butschek, who was Airbus and Daimler executive, and now he is the CEO & MD of the Indian company. he has joined the Tata Motors in February 2016. Under his leadership, Tata Motors is removing non-performing models, reducing the number of platforms, controlling the costs, quality and supplier network.

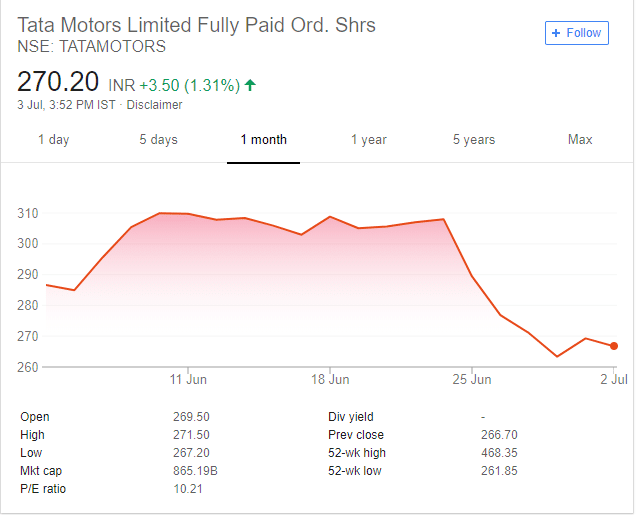

Tata Motors Stock Price Forecast

For FY19-21, Tata Motors has projected £4.5 billion capex for Jaguar Land Rover (JLR) and 12-13 percent of sales post FY21. In the fourth quarter 2018, JLR’s Ebitda margin fall by 220 basis points to 12.2%, which led to fall of Tata Motors’ overall margins. Meanwhile, US President Donald Trump has threatened to increase a trade war with Europe with imposition of a 20 percent tariff on all US imports of European Union-assembled cars.

Tata Motor’s standalone business is expected to continue to perform, with turnaround strategy in place. The company will face risks risks arising out of global trade wars. Long term investors can buy on dips with a target of Rs.350 in one year.

Disclaimer: You should not rely on any content to make an investment decision. Financeminutes.com is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.