Tata Consultancy Services (TCS) is considering a proposal to buyback shares at its board meeting to be held on June 15, 2018. This is in line with management stated strategy of giving back 80-100 percent of free cash flows (FCF) to shareholders.

The company had undertaken a Rs 16,000-crore mega buyback offer last year, involving 5.61 crore shares at a price of Rs 2,850 per equity share. In the buyback, Tata Sons had tendered over 3.60 crore shares, which accounted for 64.2 per cent of the total shares bought back by the company.

Copthall Mauritius Investments Ltd, Government of Singapore and EuroPacific Growth Fund were the institutional investors who participated in the buyback.

Meanwhile, most of the Indian IT companies are resorting to good dividends and buybacks like Infosys (Rs 13,000 crore) and HCL Technologies (Rs 3,500 crore), that had undertaken buyback of shares last year.

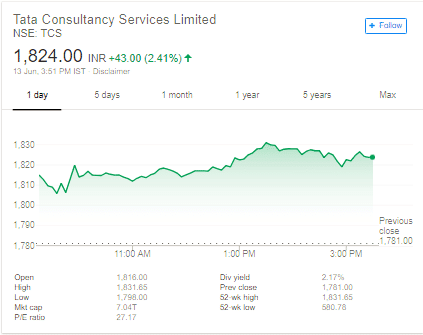

TCS Price Chart

TCS Share Price Outlook

In the fourth quarter of FY 18, all the verticals, except BFSI posted growth above company average. The three verticals grew in double digits Y-o-Y, including, Energy & Utilities vertical (+33.7%), Travel & Hospitality (+25.4%) and Life Sciences & Healthcare (+12.6%).

The company in Q4 2018 has posted 8.2% growth in the revenue to INR 32,075 crore on year on year basis and posted earnings per share of INR 36.07.

Moreover, TCS is expected to post 10% growth in FY 19, which means it needs to add $1.91 billion in new business for a 10% growth. Additionally, if the company goes for buy back, then earnings per share is will rise and the valuation of the company will improve further. The company in FY 18 has returned Rs 26,800 crore to shareholders in both dividends and the buyback.

Meanwhile, the global brokerage firm, Morgan Stanley has maintained its overweight rating on TCS however, they have raised its 12-month target price to Rs 2,010 from Rs 1,825 earlier. This means an upside of about 12 percent in the next 12 months. Further, Morgan Stanley expects the margins to move toward 26-28 percent, and has raised EPS estimates by 4-5 percent.

The investors should accumulate the stock or buy on dips with one year target of INR 2000.

Disclaimer

The content is provided for informational purposes only and it is not intended to be, and does not, constitute financial advice or any other advice. You should not rely on any content to make an investment decision.