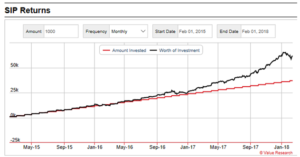

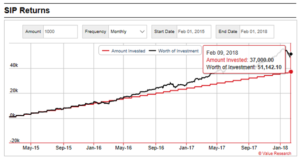

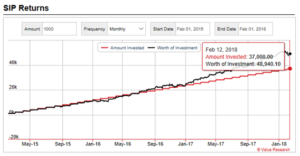

Investing in Mutual Funds with SIP is the best option for Investors who look for good returns with limited risk. Here are the 5 best mutual funds to invest for SIP in 2018 where the investors can build wealth.

The full benefit from the equity portfolio is when you keep it through periods of volatility by investing through Systematic Investment Plan (SIP), since such phases cancel out in the long run. During the past two years, the retail investors have showed maturity by systematically investing through the mutual funds.

To get the full value of SIP, one should be invested for one or two decades. Moreover, Mutual funds have given above average results, which resulted in surge in AUM. The December quarter AUM stood at INR 2,234,961 crore. Last year had witnessed huge inflows into equity and balanced funds, and the increasing participation from retail and HNI investors.

Further, SEBI has taken great measures to increase the mutual fund penetration in small cities (now account approximately 18% of AUM) and adding new investors. The best 5 funds to invest are: SBI small and midcap fund with a 5 year return of 36.95%, DSP BlackRock Micro Cap Fund Regular Plan with a 5 year return of 32.77%, Reliance Tax Saver Fund with a 5 year return of 23.20%, ICICI Prudential Value Discovery Fund with a 5 year return of 21.02% and HDFC Prudence, the consistent player.

SBI Small and Midcap Fund

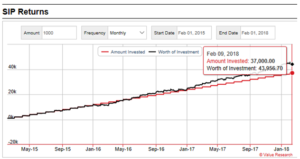

The fund has given the return of 23.93% since its launch on 9th September, 2009 and tracks the benchmark of S&P BSE Small Cap. Since it invests in mid and small cap, therefore the risk is “Moderately High”. The top holdings of the fund includes Westlife Development, Kirloskar Oil Engines, LT Foods, Relaxo Footwears, Elgi Equipments and others.

DSP BlackRock Micro Cap Fund Regular Plan

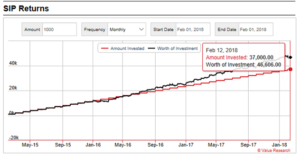

The fund has given the return of 19.61% since its launch on 14th June, 2007 and tracks the benchmark of S&P BSE Small Cap. Since it invests in mid and small cap, therefore the risk is “Moderately High”. The top holdings of the fund includes Finolex Cables, APL Apollo Tubes, Atul, Eveready Industries (I), SRF, Aarti Industries, KPR Mills and others.

Reliance Tax Saver Fund

The amount invested in this fund has a lock in period of three years, gives the benefit of tax rebate, given the return of 16.47% since its launch on 21st September, 2005 and tracks the benchmark of S&P BSE 100. The fund’s risk is “Moderately High”. The top holdings of the fund includes State Bank of India, TVS Motor, Tata Steel, Tata Motors, ICICI Bank, ABB, Infosys, Honeywell Automation and others.

ICICI Prudential Value Discovery Fund

The fund has given the return of 21.96% since its launch on 16th August, 2004 and tracks the benchmark of S&P BSE 500. The fund’s risk is “Moderately High”. The top holdings of the fund includes Sun Pharma, L&T, Wipro, HDFC Bank, Infosys, NTPC, M&M, SBI, ITC and others.

HDFC Prudence Fund

The HDFC Prudence fund has given the return of 19.28% since its launch on 1st February, 1994 and tracks the benchmark of Crisil Balanced Fund Aggressive. The fund has consistent returns over the years. The fund’s risk is “Moderately High”. The top holdings of the fund includes SBI, ICICI Bank, Infosys, L&T, NTPC, Power Grid Corp., GAIL, Axis Bank and others

Overall, investing in the funds through SIP will help to combat recent fluctuations related with inflation and a bit weaker third quarter results

Like what you read? Follow us on Twitter @Finance_Minutes to receive the latest Finance News and Analysis .

Disclaimer – The content is provided for informational purposes only and it is not intended to be, and does not, constitute financial advice or any other advice. You should not rely on any content to make an investment decision.

Pingback: SBI ETF SENSEX Next 50 NFO Review: Good Filler to your Portfolio?