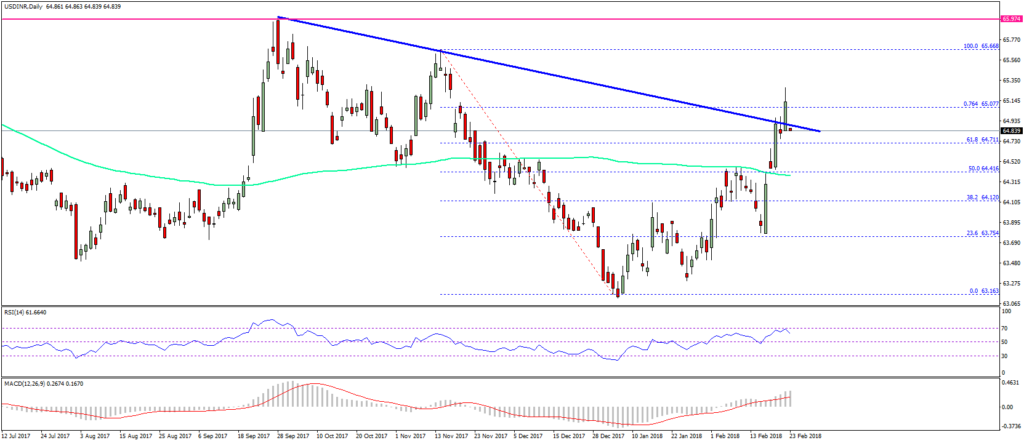

USD to INR after trading below $64.00 for a long time traded higher. It seems like Indian Rupee may depreciate further against the US Dollar during the coming weeks.

The recent decline in the Indian equity market has caught the attention of investors. However, it seems like the Indian Rupee is finding it hard to hold the ground against the US Dollar. USD/INR has started an upside move and it could gain further momentum in the near term above $64.00.

Key Points

- USD to INR forecast has turned short-term bullish since the exchange rate moved above $64.00.

- There was a break above a major bearish trend line with resistance at $64.80 on the daily chart of USD/INR.

- The pair is currently struggling for a close above the trend line, but it remains in a bullish zone above $64.20.

USD to INR Forecast Short-term Bullish Due to Pressure in Indian Rupee

It seems like the recent decline in the stock market has increased bearish pressure on the Indian currency. The PNB fraud case ignited a sharp downside move in equities, especially, the banking section.

The bank nifty recently broke a major support area and declined. It is a signal that the banking shares may struggle in the short term. This pressure has impact on the USD/INR pair as well.

Indian Rupee depreciated recently against the US Dollar as the exchange rate move above the $64.00 and $64.50 resistance levels. It seems like a bottom was formed at $63.10 and the price may continue to move higher.

Looking at the daily chart, there was a break above a major bearish trend line with resistance at $64.80. However, the pair is currently struggling for a close above the trend line, but it may regain traction as long as it is above the $64.00-64.20 support area.

On the upside, a daily close above $65.00 may result in a move towards the $66.00 level. Further above $66.00, the gates could open for a test of the $68.00 level in the medium term.

On the flip side, if the exchange rate fails to settle above the $64.80 level, then it may correct lower towards the $64.20 and $64.00 levels, which are decent supports.

Recently, the greenback faced a lot of selling pressure, since the Euro to Dollar gained traction. In the cryptocurrency arena, there was an increase in the bearish pressure on bitcoin, Ethereum and other altcoins.

Ethereum price recently dropped below $800, and it seems like it could continue to move down. Overall, the share, forex and the cryptocurrency market may remain under pressure for some time before it started recovering.