Though it’s part of our everyday vocabulary but the word investments carry a lot of significance. For some, the term means saving money to get better returns and for others, safety is of prime importance. Hence, there are several products available in the financial market to tweak with the demands raised by the customers but we recommend SIP.

There are two kinds of investments:-

- Investments for fearful genre- Like conventional FD’s

- Investments for people with spinal cord- SIP and stock market investments

So, if you belong to the first category, read no further, but if you are a person with guts read it aloud.

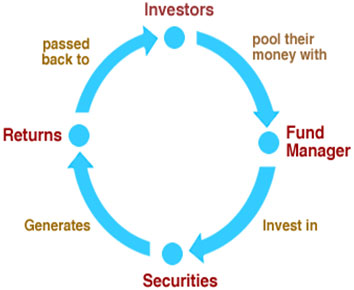

Some calamities are more dangerous than natural disaster- stock market crash. Yes! Though the stock market investments promise high returns, but not everyone can afford to risk their hard earned money. Hence, a better substitute is SIP-Systemic Investment Plan. It is a tiny monthly commitment that risk- averse investors make especially in the small towns. In the blog post, we will highlight how SIP plans are better than the stock market investments.

Entry level investment

When an individual enters the stock market, it is presumed that he/she has a full knowledge of the technical analysis, circuit filter, and a host of bizarre stock market terms. But if you are not expert in this subject matter and still want to earn returns better than the bank deposits, we recommend you to start a SIP with a good bank or financial company.

Changing Trend

Recently, it has been noticed that there is a clear shift from conventional assets (as the bank rates have come down) and physical assets (gold and real estate) because it has not been able to provide great returns in the past few years. Hence, the inclination towards financial assets has increased (equity’s long- term performance has been better than physical assets). As we all know the share market is not meant for impatient and emotional investors, so the best option is SIP.

Disciplined Investment

The main reason why the small investors are sticking towards their SIP is because it is the simplest way of investment. When the markets tremble or become volatile, the equity investors start having second thoughts about their investment. While SIP inculcates a sense of discipline among the investors because the amount needs to get invested on a due date, without fail.

In the end, we would like to conclude though SIP investments are a great way to accumulate wealth; still, some small investors tend to get swayed by the rise and fall of the market. Hence, they discontinue their accounts when the market is expected to boom. This is the worst mistake that any investor can make. Actually, this defeats the whole purpose of investment.

SIP is actually a “small step towards big returns”. So, keep investing and earning.

Pingback: Best Mutual Funds for Students in India