The rising inflation has weathered our investment portfolio just like a deck of cards. Hence, there comes a question where to invest to beat the inflation? Well, the article ponders on the best investments for you.

Indexed Bonds

RBI Inflation Indexed National Saving Securities Cumulative Bond offers a higher return of 1.5% over and above CPI based Inflation rate. Starting from individuals to HNI to charitable institutes to Companies under the Indian Companies Act and Universities incorporated by Central or State can invest in such instruments.

The nationalized banks can be approached for the investments. The minimum amount that an investor can park is Rs 5000 and the maximum amount is Rs 10 lakh per year for the retail investor and other institutional investors can invest upto Rs 25 lakhs.

-web.jpg)

Image Credit- Live Mint

Equity Investments

Though the stock market may seem volatile, but there is no way to beat the market inflation except to invest in the equity stock market in a measured and tax-efficient way. There are various stocks like SBI, ICICI, HDFC banks that are worth investing for. The best part of such investments is if you invest in the equity stock market, you will not have to face old age poverty concerns. There is no other way.

Multi Cap Funds- Such funds invest the money in diversified mutual funds and it is seen the returns from these funds have beaten the inflation rate now and again.

| 5 Years | 10 Years | 15 Years | |

| CAGR (%) | 16.25 | 18.30 | 16.65 |

| Inflation Adjusted CAGR (%) | 11.31 | 10.89 |

Large Cap Funds-The returns from these funds are less volatile in nature and have beaten the inflation rate over the years.

| 5 Years | 10 Years | 15 Years | |

| CAGR (%) | 13.60 | 15.82 | 15.69 |

| Inflation Adjusted CAGR (%) | 8.66 | 8.41 | 9.20 |

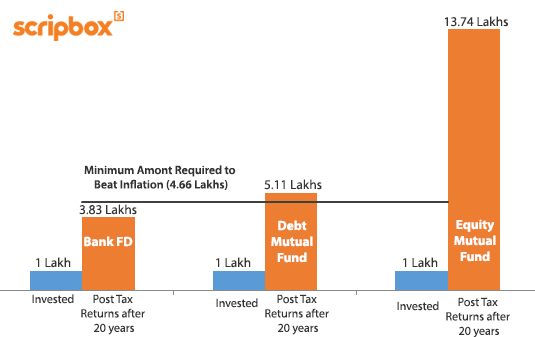

Mutual Funds

Creating a successful portfolio of mutual funds is not easy. The investor needs to analyze the different strategies to create it. There are various mutual funds that can help to beat the growing inflation like growth stock mutual funds- these funds perform the best when the economy is growing at a rapid rate. Another mutual fund that is must invest when inflation intensifies is foreign stock funds that act as a hedge over the money invested in the foreign currencies which is translated into more dollars.

Image Credit- Scrip Box

Bonds

Though people believe bond funds are not worthy to invest in an inflationary environment because the bond price moves in an opposite direction of interest rate. However, a rational investor still invests in bond funds like intermediate bond funds and inflation protected funds.

Image Credit- Capitalmind.in

Gold

Though gold has failed to beat the inflation rate, but it has generated adjusted returns in a longer period.

Standard Gold – Mumbai

| 5 Years | 10 Years | 15 Years | |

| CAGR (%) | 0.61 | 9.29 | 11.71 |

| Inflation Adjusted CAGR (%) | -4.33 | 1.88 | 5.22 |

These are the best investments can definitely help you to to beat the inflation rate and give you handsome returns in long term.