A month ago five stock options multiplied the yield of the Standard and Poor’s 500 indexes in January. This month, we have come up with five of the best US stocks to buy today for short term gains in February 2018.

Western Digital Corp (WDC)

WDC is a value play. Additionally, it has good yield reports. On January 24th WDC gave a report that its profit increased by 9 percent over the holiday quarter, as per the estimates. The adjusted EPS were $3.95 which exceeded the estimated EPS of $3.79. This reason makes it be one of the best stocks to buy today for February.

Bruker Corporation (BRKR)

Being a producer of scientific appliances for molecular and materials research, Bruker Corporation stock has grown by 10.7% over the past 11 years. Throughout the past 4 years, EPS has regularly grown to the final quarter from the third quarter. If this pattern proceeds, the stock ought to have a high likelihood of trading up during the month.

For EPS modifications, the stock holds a review of B; this supports the likelihood of an increase in revenue. In spite of the fact that the stock is in position 148 out of 362 in the healthcare sector, it’s difficult to overlook a 100% hit rate in the course of the recent 11 years.

Customers Bancorp Inc. (CUBI)

In spite of an amazing 19 percent increase in the period of January alone, this bank stock is as yet an appealing pickup for any class of trader.

CUBI is becoming a noteworthy quarterly beat and plans to turn off its Bank Mobile division by the start of the third quarter. The spinoff ought to give $3.57 per share to CUBI stock proprietors; additionally, experts anticipate that the stock will acquire $2.78 per share in 2018.

If you multiply that $2.78 by 15 which the price-earnings ratio and add the $3.57 per share spinoff, you get $45.27, or around a 46 percent upside to its present value, which is around $31 per share right now.

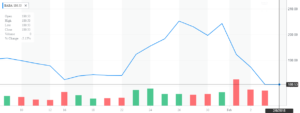

Alibaba Group Holding Ltd (NYSE: BABA)

This is an e-commerce leader in China which is one of the best stocks market option. Additionally, being chosen as one of the best stocks to buy today for 2018, there’s no reason BABA can’t catch up its amazing January outperformance where shares increased by 18 percent with another amazing performance showing in February.

International Business Machines (IBM)

By the end of 2017 IBM reported its first quarter revenue increase in more than 5 years. In 2018, IBM also anticipates to expand its revenue which is a sign of multi-year modification. Income from this organization represented 46% of aggregate income in 2017, which is 11% increase.

With adjusted EPS of $13.80 anticipated for the year 2018, the stock exchanges for only 11.6 times profit. Additionally, remember the dividend, which yields 3.7% and consumes not as much as half of the adjusted income. It is therefore now an ideal opportunity for you to buy this stock.

Pingback: Nikkei 225 Carved Major or Intermediate Top at 24,000?

Pingback: US Inflation Data: 5 Things Investors Must Watch