Japan’s benchmark Nikkei 225 index has fallen more than 1,500 points at its lows on Tuesday, however the benchmark has reduced some of those losses ahead of its Tuesday’s close at 21,610.24 as stocks across sectors pulled back.

The benchmark Nikkei 225 reacted after the huge U.S. sell-off on Monday, which saw the Dow Jones industrial average breaking below the 25,000 level and paring the gains made by the index this year. Additionally, other indices like Hong Kong’s Hang Seng index fell about 4.1 per cent and the Kospi in South Korea fell about 1.4 per cent.

Apart from the selloff in US market, there were other factors. This includes the expectations for Japanese corporate earnings growth in FY17 and FY18 and fall of US dollar against the Japanese yen. The investors were betting on the US economy due to strong expansion improving corporate earnings and stable inflation, but the trend seems to be changed. The dollar had appreciated against other major currencies overnight.

Bitcoin also declined sharply below $7,000 as the whole cryptocurrency market tumbled.

Fall in US Stocks Market

Japan’s Nikkei 225 fell 4.7 per cent, which is its worst fall since November 2016 and taking the index is down to a four-month low. Nikkei 225 had followed US market, whose US benchmark S&P 500 also fell by more than 4 per cent while the Dow Jones Industrial Average fell 4.6 per cent on Monday.

This is due to inflation fears after strong US jobs data at the end of last week that triggered a surge in bond yields and led to sell-off across US stock markets. The rising wages in the US will lead to the rise of inflation, which may force the US Federal Reserve to tighten the money supply and increase the borrowing costs. Further, the Futures market is anticipating more US selling.

You can check Best US Stocks to Buy Today for short term in 2018 during the current turmoil and trade accordingly.

Nikkei 225 Price Chart

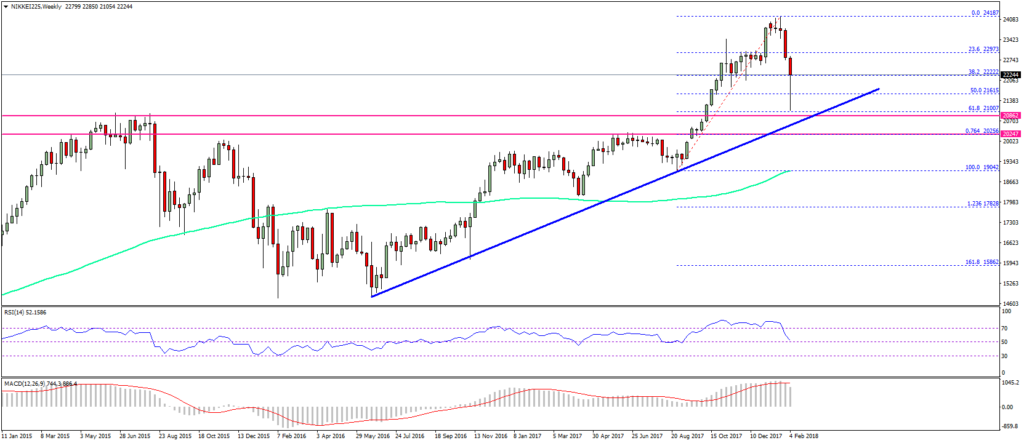

Looking at the Nikkei 225 weekly chart, we have taken three years period, at 24,000 level (shown by purple dotted line) a major top formed, and then the market fell to the 22,000 level.

Even it break below 22,000 which is crucial, then 20,000 is a decent support and strong support if we consider the history of the index movement. However, today on 7th February there is a decent pullback, can dive one more time, but downsides are limited by the 21K and 20K support levels.

Steps by top Japanese Lawmakers

The top Japanese lawmakers have moved to decrease the concerns. Although Finance Minister Taro Aso declined to comment on the stock prices, but said that the corporate performances were not getting worse. Even Economy Minister Toshimitsu Motegi said that he was keeping a close watch on the market movements and added that Japan’s economy remained stable and improving.

Overall, Nikkei 225 should not fall below crucial 22,000 level, but there can be range moves since Nikkei has made a short-term top at 24,000 level.