After the BJP government, came into the force in May 2014, it seems the Indian markets have gained momentum. Day after day we read the newspaper vouching for the same. Monday was also not an exception.

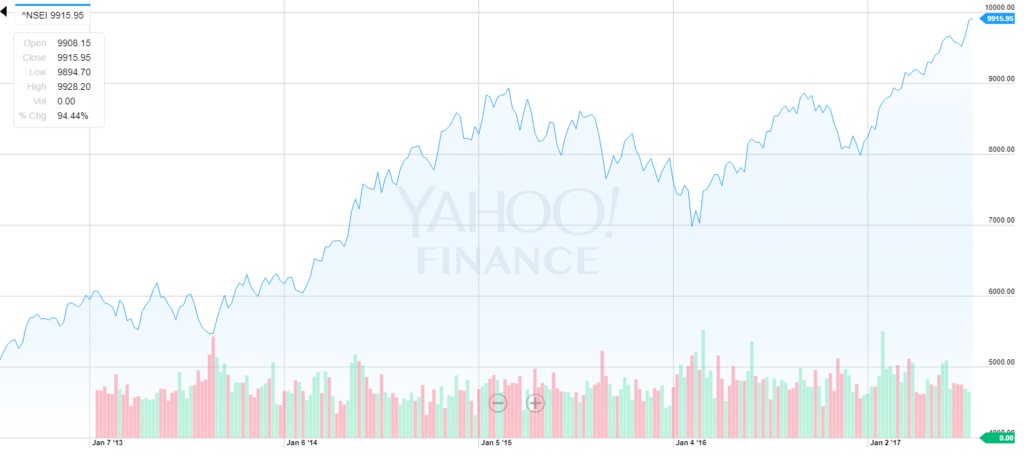

The key indices Sensex and Nifty were in green as both the markets closed. The 30 share BSE Sensex gained close to 54.03 points while the 50 share NSE Nifty ringed the bell at 9,915.95. The intra- day trade also posted strong.

A Shock Wave Felt

But what erodes the positive sentiments is it seems that most of the stocks have either remained range bound or are counted as the losers, thanks to the implementation of GST. GST is a revolutionary step taken by the government with the belief “one nation one tax”, but contrary to the perceived notion major stocks like ITC, Cadbury has slipped down. Apart from that, the major losers that have petrified the stock market include Pharma companies (owing to US regulatory controls), Coal India (unable to keep its head up with the changing trend), IT sectors (thanks to the likely changes in the US visa program), and energy sectors that is compelling to decline its status. Well, call it as a GST effect or a global reason, but it seems that the Indian markets are not in tandem with the positive outlook.

The Statistics Unfolds

The figure says it all. Have a look at them:

The heavy weight stocks like Reliance Industries, Maruti Suzuki, HDFC Bank, IndusInd Bank and Hindustan Unilever are buzzing and have created a rosy picture. While on the other hand, the pharma stocks, Tata Consultancy Services, ONGC, Oil India and Coal India are trading at 52 weeks low.

The situation has arisen where the market fundamentals need to be relooked once again. The market gurus are still optimistic about mutual funds stocks thinking that the small saving could uplift the market once again. Aside from that, there are several other stocks that have strong uptrend like Power Grid, Tata Chemicals, Hindustan Petroleum, Havells, Apollo Hospital, Sun TV, Arvind, etc. After the passage of Bankruptcy bill by the government, the banking stocks have become hot cakes.

Well, in the end, we would like to conclude that that here in this article we are not suggesting you to make specific investments because it is unethical to reel off names unless you are a financial advisor. Sometimes even the most extensive research falls short of unexpected events. The only advice we want to make is:-Be cautious and build a well-diversified portfolio to grow wealth. That is the attitude that we wish every investor to acquire for.

Pingback: BSE Sensex and Nifty Skyrockets after GST; Can it retain gains?