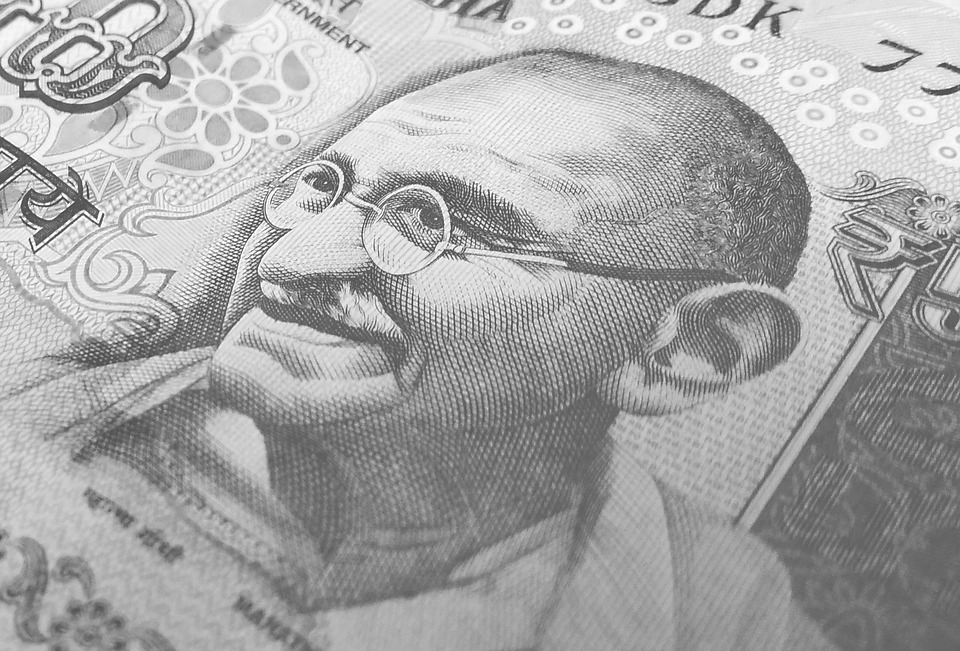

In an effort to address the issues raised by the Jewelers’ Association across the country, BJP led central government and the GST council has decided to withdraw the requirement of submitting a PAN Card copy on purchase of Jewelry above Rs. 50, 000.

Notification withdrawn under Prevention of Money laundering Act, 2002 (PMLA)

GST council has withdrawn the notification that was also applied to Jewelry purchases to mandatorily submit a PAN Card copy on purchasing jewelry of Rs. 50,000 & above. This also means that Jewelers are no longer required to report the buyers to the Financial Intelligence Unit when a purchase is made of Rs. 50, 000 or more.

Under the Income Tax act, cash sales up to Rs. 2,00,000 is allowed without any need of identity proof and the same was argued by the jewelers that a limit of Rs. 50,000 & above would discourage the honest consumers due to fear of unnecessary watchdog.

The decision of withdrawal came after the meeting of GST Council happened on 6th October.

This has come at a good time for Indian consumers and jewelers. The season of festival is yet peak with Diwali and rightly placed for the typical wedding season in India where people buy gold in huge quantities.

Boon for blackmoney hoarders?

With more than 90% transactions that happen in India are cash based, upgrading the limit from Rs. 50,000 to Rs. 2,00,000 without the need of KYC would further fuel the use of cash in the economy. Government’s initiatives to encourage ‘Cashless transactions’ & ‘Digital India’ would be hit by this move.

Blackmoney hoarders have got an upgrade to escape their incomes and keep it untraced from the government and its agencies.

It is no hidden fact that Indians after real estate spend the most on buying gold as a long-term capital investment. Now due to removal of this limit, tax evaders would get be able to evade more taxes without leaving any traces of such transactions.

This would also impact the cash levels in the economy as more physical currency would be in demand. It is going to be a big blow to the cashless India vision of PM Narendra Modi.

Should the finance ministry, GST council and PM Narendra Modi re-look at this decision and sit with the industry representatives to take proper decisions to help them be more vigilant and help the government in encouraging financial discipline among the common citizen?

This is especially when 99% of the adult population has an Aadhaar Card it looks to be a regressive step by the government.

Pingback: Gold Demand Surges with Diwali, Long Recession Ends?