Facebook owned WhatsApp is going to soon launch ‘WhatsApp Business’ that would let the businesses target its consumers over WhatsApp with features such as Auto-responses, business profile, chat migration and analytics.

Through the new app, Facebook aims to recover some of the money that was spent to acquire WhatsApp. Right now the app is in beta version with a few vendors trying to explore the features and implement their use cases.

In an economy such as India with initiatives such as Digital India, Cashless India, it definitely looks to give a boost to digital transaction helping the economy grow faster.

In an interview with Wall Street Journal, WhatsApp’s Chief Operating Officer, Matt Idema said that, “We do intend on charging businesses in the future. We don’t have the details of monetization figured out.”

WhatsApp Business is different from the regular WhatsApp

A major push to Digital India & Cashless India

PM Narendra Modi, after announcing Demonetization in November 2016, has focused a lot on creating Digital India and cashless India.

In a recent address by PM Narendra Modi in Gujarat, he said that, “Digital technology, digital literacy, and digital India should be the focus of a good government.”

Modi further said, “A Digital India guarantees transparency, effective service delivery and good governance.”

He added, “Work is underway to spread digital literacy to every part of India, among all age groups.”

Post 8th November 2016, digital transactions have gained momentum with the government setting a very aggressive target of 25 billion transactions in FY2017-18.

Monthly transactions by volume has crossed 1 billion in July 2017, as per the National Payments Corporation of India (NPCI).

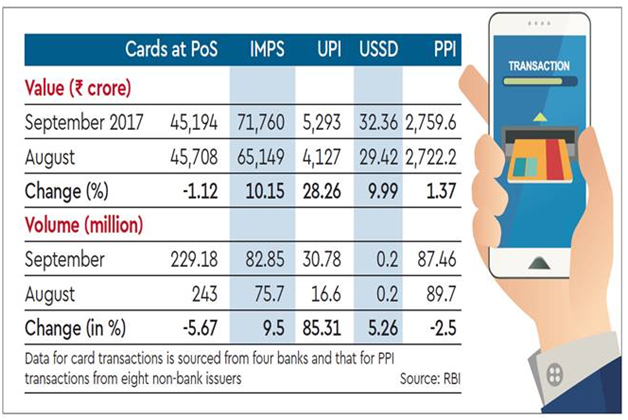

Among all the methods, Unified Payments Interface (UPI), has seen the sharpest rise of 85% on a month-on-month basis in volumes with average transaction of Rs. 1,719 down from Rs. 2,486 in August.

On 18th September, Google, world’s largest internet company, had released a mobile app, Tez, for mobile payments based on the UPI framework that helps transfer money from one account to other in a span of few seconds on mobile.

The e-wallets such as PayTM, Mobiwik, PhonePe, PayU, Jio Money, Ola Money, government’s own BHIM app, Google Tez have been promoting cash less transactions and according to a report, digital payments in India are expected to touch $500 billion by 2020.

This is simply because in India more than 95% transactions are done in cash and cheque which is set to come down through digital literacy, technological adoption & break-through and government’s push to digital.

Image Credits Financial express

India, the largest market for WhatsApp

As per the report by Counterpoint Research, India today has 1.16 million subscribers with over 90% penetration and roughly 25% of them are using smartphones which is close to 300 million users.

The smartphone penetration is expected to reach 58% and would have roughly 650 million users by 2020 as per a report by Google & BCG.

WhatsApp has active user base of 200 million in India which is largest in the world for them and India is the second biggest market for all the messaging apps after China.

With WhatsApp Business, Indian economy is all set to be growing through digital transactions that are done on mobile. WhatsApp is already used by people informally to conduct business and provide services particularly in Asia.

This could well be a WeChat moment (in China) for WhatsApp in India. Indian businesses, traders, freelancers and big corporates would quickly jump to grab a share in WhatsApp Business and take the consumer engagement to the next level.

It is about time that India needs to have a disruption in the way it conducts its business and move the cash faster in the economy that in simple words means, Accelerated Growth.

Pingback: WhatsApp Business to Mint Money with Service Charges, Pros and Cons