Bitcoin is the only crypto which witnessed resilience to fall down, while Altcoins were red this week. Among the top ten coins by market cap, Stellar (XLM), Bitcoin Cash (BCH), Cardano (ADA) and Ripple (XRP) were in red.

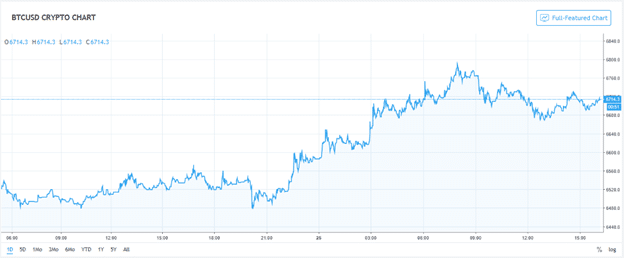

Bitcoin BTC/USD Weekly Chart

Bitcoin (BTC) price is at the level of around $6720. The major support is at a level of around $4970 and the major resistance is at a level of around $8100. Bitcoin is the only cryptocurrency which is showing relative resilience to fall down despite the latest ETF rejections. On a weekly chart, BTC has moved up more than 6% this week. BTC/USD is expected to consolidate next week.

SEC Initiated Review of Nine Bitcoin ETFs

The U.S. Securities and Exchange Commission (SEC) had rejected proposed rule changes for nine bitcoin ETFs, in which three rejection orders were made on August 22nd. The bitcoin was not much affected by the news. Currently, the Commission has initiated a review of all related decisions and stayed the orders made on August 22.

This is the first time that SEC has initiated the review on the decisions made. However, the Commission did not confirm which Commissioner(s) is called for the review, but Commissioner Hester Peirce confirmed on social media about the review to be taking place.

China’s Move this Week

During this week, China had forbidden all commercial venues from conducting any events related with crypto in Beijing’s Chaoyang district. The country is also targeting communication channels or “loopholes” through which the Chinese investors invest in to Initial Coin Offerings (ICO) and crypto trading. China’s leading social media platform WeChat has permanently blocked lot of cryptos, as they are suspected of publishing crypto “hype” on the back of violation of regulations introduced earlier this month.

Ethereum ETH/USD Charts

Due to news related with rejection of Bitcoin ETF, Ethereum (ETH/USD) was not able to recover. The monthly chart of the coin looks weak. Ethereum is trading at a level of around $280. ETH has fallen sharply in 3 months by around 30%, therefore the investor’s interest in this crypto is very low now.

All other cryptos have also fallen but ETH has witnessed sharper fall, though nothing has fundamentally changed. The implementation of on-chain scaling solutions such as Sharding and Plasma Cash, as well as off-chain scaling will attract Ethereum investors in the future. However, due to lack of infrastructure, the investors stayed away from this crypto.

This week the discussions are going in South Korea to potentially reverse the country’s ban on initial coin offerings (ICOs), which would be positive for Cryptos. As per the fresh research, volume of the global automotive block-chain market is expected to reach $1.6 billion by 2026. The numbers are derived from the financial analysis of key market players, that includes Ethereum (ETH), IBM Corporation, Ripple Labs Inc. and R3.