Ethereum price declined to a new three month low below $500 against the US dollar. However, ETH/USD is now testing a significant and long term support.

The past few days were pretty bearish on Ethereum as the cryptocurrency Ether declined more than 50 percent from well above $1,000 to well below $600. Bitcoin price also struggled during the past few weeks and settled below $10,000. It tested the $7,500 support recently before starting a recovery.

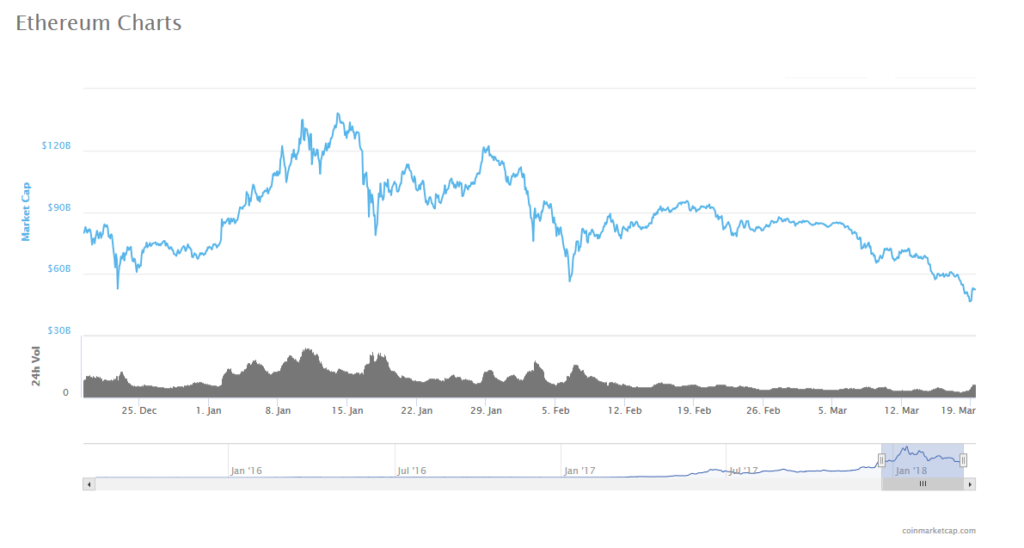

However, Ether tumbled sharply compared to bitcoin and the market cap of ETH tumbled from well above $130 billion to $46 billion (as per coinmarketcap).

The third major cryptocurrency, Ripple too faced a lot of pressure, but as per our last analysis, Ripple price tested a crucial support and bounced back. XRP/USD will most likely continue to hold the $0.50 and $0.60 support levels.

Ethereum Price Analysis and Long term ETH/USD Outlook

As mentioned, the past few days were very bearish and Ethereum price declined below the $800 and $700 support levels. Looking at the weekly chart of ETH/USD, there is a clear downtrend visible from the all-time high of $1,425 (price data feed via bitfinex exchange).

More importantly, there was a break below the 50% Fib retracement level of the last wave from the $134 low to $1,425 high. It is bearish sign, but the price is now approaching a crucial support near $440-450 (chart prepared – Trading View).

There is a monster bullish trend line with a long term support at $450 on the weekly chart of ETH/USD. The pair recently tested the same trend line and recovered around $50.

Ether’s price is now trading above the $500 level and the $450 support remained intact. There was a test of the 76.4% Fib retracement level of the last wave from the $134 low to $1,425 high as well.

It seems like the highlighted trend line and support at $450 holds a lot of importance for the long term trend. If there is a break and weekly close below $450, the price may slide towards $200.

However, the chances of a downside break and close below $450 are very low. As long as Ethereum price is above the $450 support, it could recover. The weekly RSI is hitting the 50 level, which could also produce an upside reaction in the near term.

Pingback: ICON’s ICX Price Prediction $10, $14 and $20