Ripple price (XRP/USD) declined heavily during the past few weeks and settled below $0.60. XRP price may continue to decline, but a break above $0.58 and $0.60 could open the doors for a solid recovery.

The past few months were mostly bearish in the cryptocurrency market. Almost all coins including ripple struggled to recover and the total XRP market cap declined from well above $120B to below $25B (as per coinmarketcap).

Other major coins also faced a lot of heat and declined. Bitcoin price is trading well below the $8,000 pivot level, Ethereum price is struggling to hold the $400 support and litecoin price tested the $120 support.

Ripple Price Forecast Takeaways:

- Ripple price is holding a major support area near $0.4500 against the US Dollar.

- There is a monster bearish trend line with resistance at $0.53 on the 4-hour chart of the XRP/USD pair.

- The pair must break the $0.58 and $0.60 resistance levels to start a decent upside recovery.

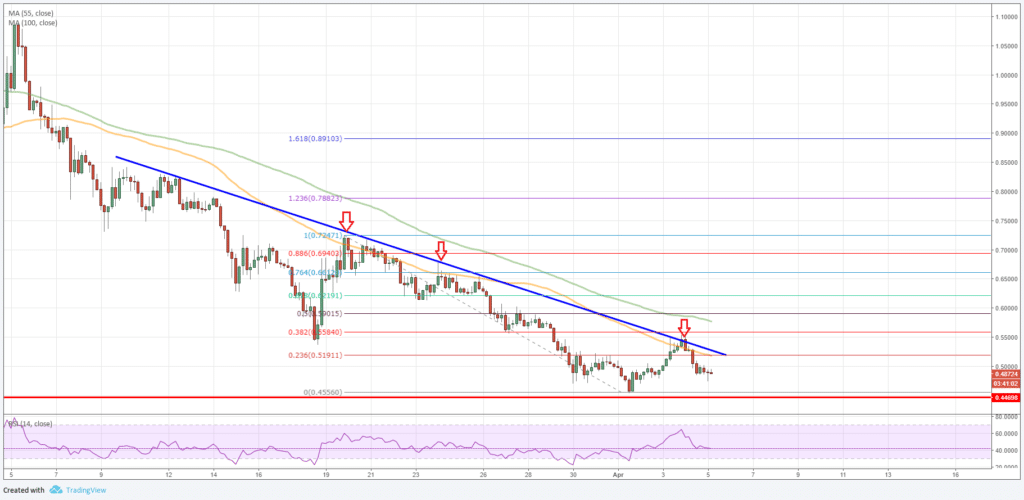

Looking at the 4-hour chart of xrp to usd price, there is a clear downtrend visible from well above the $1.00 handle. The price declined and broke many supports such as $0.80 and $0.60.

It recently traded as low as $0.4550 (data feed via bitfinex) before a minor upside move initiated. It traded above the 23.6% Fib retracement level of the last decline from the $0.7247 high to 0.4550 low. However, the upside move was protected by the $0.5500 level.

Moreover, a monster bearish trend line with current resistance at $0.53 on the 4-hour chart of the XRP/USD pair also acted as a barrier for buyers. Lastly, the price failed to move past the 38.2% Fib retracement level of the last decline from the $0.7247 high to 0.4550 low.

It is currently trading lower after it got rejected from the $0.55 level and the 150 simple moving average (orange) on the same chart.

How XRP/USD Can Start Upside?

The main question here is how ripple price can start a decent recovery? It seems like XRP/USD has to break a few important hurdles such as $0.55, $0.58, 150 simple moving average (orange) and the bearish trend line to start an upside recovery.

However, the main hurdle awaits near $0.60 and the 100 simple moving average (green). A proper close above the $0.60 resistance and the 50% Fib retracement level of the last decline from the $0.7247 high to 0.4550 low is required for a fresh recovery.

Once there is a close above $0.60, the price may head towards the $0.80 and $1.00 levels. On the flip side, if ripple price fails to move above $0.55, there is a risk of a downside break below $0.45.

A push below $0.45 may perhaps call for a test of the $0.40 and $0.38 support levels. We can also keep an eye on altcoins such as OMG, Steem, VeChain, EOS, ICX, Neo, BNB, Bitcoin cash, QTUM for the price action and upside break.

Pingback: Ripple Price Forecast: XRP/USD is Back in Uptrend

Pingback: Ripple Price Analysis: XRP/USD Bearish, Upsides Capped